This article accompanies and enlarges upon the interview with Dil Green that we published recently, as part of series of articles on a forthcoming book about building a new economy around a mutual credit core.

The ‘New Economy’ discussed here is not a proposition for radical discontinuity, and still less an artefact of wishful thinking.

Whatever the urgency of a transition to an economy that interacts healthily with the biosphere, no proposition for this transition can succeed that does not present as a beneficial ‘adjacent possible’ for some significant fraction of the billions of pragmatic economic choices that are made each day by people with perfectly reasonable desires for security, dignity, and agency.

Much ‘New Economy’ thinking is infected by ‘shoulds’ and ‘oughts’; these translate, crudely speaking, into moralising pressure and policy impositions. These are of course valid social mechanisms, and have their place, but when we look at the context of those daily billions of choices, we see that they are conditioned most immediately by the underlying protocols around how money works – both as a means-of-exchange and as a store-of-value.

It is these basic ‘rules’ that lie at the foundations of all economic relations, institutions and customs (broadly, these rules are: money as a commodity/asset, centrally issued as interest-bearing debt, subject to both systemic and imposed scarcity) – and they constitute a kind of artificial physics, impervious to both moral and policy prescriptions. Upon this ‘physics’ has been constructed the vast and complex edifice of modern economics and finance.

Two New Economy approaches which can alter these underlying rules without changing the immediate ways in which money is used for exchange or for investment – which do not require strange new language or deep study of monetary theory to provide immediate and obvious benefits to ordinary economic actors in a wide range of circumstances – are ‘continuous clearing’ and ‘use credit obligations’. The former offering an alternative to the underlying ‘physics’ of the means-of-exchange function of money, and the latter to the store-of-value function.

These are the Two Planks referred to in the title.

However, the speed and scale of the transition that is required if our civilisation is not to be faced with existential threat is such that we cannot simply offer beneficial new mechanisms into the economic landscape for use and wait for these to be adopted, adapted and evolved.

We need also to understand that those who for whatever reason have significant asset holdings in the current economy are needed – that their active and voluntary participation in this transition is required, to ensure its rapid development – and thus that this participation must translate into the assets of the New Economy, as well as offer desirable environmental and cultural outcomes.

Thus we also need a Bridge: the purpose of this piece is to outline the two planks, and then to show how they can be combined to offer a bridge into the New Economy for those who hold assets in the old.

Continuous Clearing

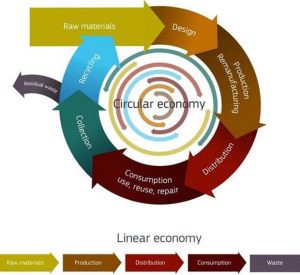

It is almost a truism now to claim that the New Economy will be more collaborative – that it will function more like an interconnected ecosystem than a series of industry verticals – that it will have more circular flows with less extraction and less dumping.

But the money we have – its physics – works systemically against collaboration, since it imposes a competitive landscape around access to means-of-exchange liquidity and investment finance that makes collaborators always vulnerable to carpetbaggers of one sort or another – whether it is privatisers at state level, de-mutualisers with co-ops and building societies or activist investors demanding corporate break-ups.

Continuous Clearing is a simple mechanism that, within a collaborative context, changes this physics, without requiring any significant change to ordinary business practice or analysis. Very simply, within a collaborative context (defined by a mutual membership agreement with narrow and specific reach), all invoices are registered with a trusted third party in the role of service partner, and settled immediately using an internal credit unit – generally known as Mutual Credit Units (MCU). This third party continuously updates – and publishes – each member’s balance relative to the whole group. Thus if any member wishes to leave the group, one single payment (or receipt) will settle all outstanding commitments. No interest is payable on balances within the group.

It’s as simple as that. The immediate benefit is shared trade credit risk: since all invoices are paid on demand in MCU, the failure of a member imposes no immediate loss on any other member. The loss of a member from the group imposes a general loss in spendability of MCU, but in a sizeable group, this becomes marginal. Within the group, means-of-exchange – purchasing power – is limited only by members’ willingness to trade – there can be no externally imposed credit crunch.

Onto this simple mechanism, some simple layers are added which further reduce risk – credit/exposure limits and settlement periods. At the end of each settlement period (which could be as short as a few hours, or as long as a few years – depending, as do all policies, upon members’ joint decisions), each member receives or makes a single hard currency (ie pounds or euros) payment that brings them back within their account limits.

In this context, collaboration is rewarded by the underlying physics of the means-of-exchange: as members see the reduction in risk, they are likely to increase their maximum exposure to the other members – generating increased liquidity and opportunities for intertrade.

Clearly, there are many detailed issues to be addressed around this system. Happily, there is significant experience with such networks that provides a wealth of wisdom around these issues. The Swiss WIR Bank has been operating with a similar approach since 1933 with a turnover in the billions, and more recently the Sardex network in Sardinia, launched in 2009, now handles over €50m annually.

Of course, such groups cannot get too large, since this would make it hard for any member to assess how trustworthy the group is as a whole. This limits the pool of ‘internal’ trading partners and thus the benefits of membership. The issue is addressed and resolved by federating such groups into ‘groups of groups’ for further risk reductions and liquidity benefits.

In the context of a ‘group of groups’, the internal willingness to pool trade credit becomes, from the point of view of other member groups, a form of mutual assurance – when offering credit to an established group of businesses as a single entity, default would require the collapse of the whole group, rather than any single member. Once again, credit risk is reduced, confidence is increased. Several tiers of such networks can cover all types of condition – geographical localities, bio-regions, continents, most obviously, but also communities of interest and of practice, industry horizontals and verticals.

Mutual Credit Services have developed software on the basis of the Credit Commons protocol that manages such federated network and third party service provision.

Use Credit Obligations

The internal credit units – MCU – used within Continuous Clearing groups provide a means-of-exchange, but MCU are not intended, by design, to provide long-term store-of-value; a large positive balance is more an indication of exposure to the future willingness/ability to trade of other group members, where risk clearly increases over the longer term, than it is a condition of wealth.

The increased liquidity and freedom from interest-bearing debt offered within a Continuous Clearing network requires this separation of means-of-exchange functionality from store-of-value – if MCU worked as long-term, reliable wealth, the incentive would be to hoard them, rather than spend them on – reintroducing systemic shortage of liquidity. Continuous Clearing groups encourage the spending of surplus credit – for a dynamic, high turnover economy with a money supply that ‘breathes’ – expands and contracts according to need.

But economies need store-of-value mechanisms – for investment, for savings, for insurance. Our current money works poorly in this role. Its dual use as means-of-exchange and store-of-value results in difficult-to-predict fluctuations in spending power that make it hard to rely on for anyone not in the 1% – whether as a result of inflation or the ever present crises around pensions and asset bubbles of all kinds.

Use Credit Obligations (UCO) provide a store-of-value tied to more objective fundamentals, such as energy, land-use and the like. On a smaller scale, they can equally be tied to productive output of any standardised kind. Essentially the issuer guarantees to accept such tokens as payment for a unit of production under specified conditions.

Clearly a stock of ‘square metre rent tokens’ or ‘kilowatt hour tokens’ from an institutional issuer provides a reliable store-of-value to ensure security of location and access to energy that is inflation-proof – perhaps not in monetary terms, but in what matters for security: real utility – since these tokens represent an actual quantity of something tangible and inherently related to consistent human needs.

It is the ‘investment’ use of these tokens that we are most interested in here. If a community wishes to put up a wind turbine, say, using the UCO approach, they can raise investment finance by selling UCOs at some discount. This provides finance without debt or giving away equity (governance structures, not discussed here, can bring investors inside the project to address concerns around risk management). Investors can achieve their desired rate of return and realise it either directly, by buying energy, or by selling these tokens at their market value (which will tend to increase as the turbine gets closer to completion and then settle once it comes on stream).

Again, any specific case would require much detail to be developed around this core idea, but the essentials should be clear from this simplistic example.

The Bridge

The idea of the Bridge is inspired by a section in Yanis Varoufakis’ “Talking to my Daughter about the Economy”, in which he talks about the birth of capitalism through the lens of the wool trade in England. Feudal landlords had the assets – the land, the serfs and beasts that lived on the land. And they acquired and held them by deploying power; land was not for sale, and neither was labour. Wool merchants, though, convinced landowners to throw the serfs off the land and to rent it in exchange for gold so that the merchants could grow wool and sell it for even more gold.

The lords thus gave over control of the key asset of the feudal economy – land – in exchange for the key asset of the new economy – gold. In order to realise the value of that gold, though, they had to spend it into that same new economy. The feudal lords both funded the development of market economies by providing land, and then helped to expand their scope by spending investment returns into those same market economies. Thus over time the new asset – gold, became more desirable than the old – land, because it was useful in many more ways, until eventually land itself became a saleable asset – enabling it to be allocated to more productive uses through peaceful trade rather than violent struggle.

We can now see how we can use the two planks above to build an equivalent bridge from the current, extractive economy into the new, collaborative economy.

If we raise investment in pounds and dollars, which we use to build the new economy – most obviously, to finance the development of new, collaborative enterprises – and pay fair returns on those ‘fiat currency’ investments in the currency of the new economy – in UCO and MCU – then in order to access the value of those returns the investors will have to become participants in the New Economy.

Again, as with the transition from feudalism to capitalism, this will be a welcome move for many – the simple fact of being wealthy does not mean that an individual does not care about the damaging impact of an extractive economy on the biosphere.

Need more detail? Wonder how this can be put into practice?

In service of readability, this piece has been kept as short as possible, and thus everything here is a simplified sketch. The collaborators in the Mutual Credit Services partnership and their advisers have already developed these ideas in some detail and continue to refine them alongside more straightforward software and governance developments. We are already building real-world networks. We welcome collaboration of all kinds.

This article was first published on Dil Green’s Digital Anthropology blog.

A Director at Lowimpact.org and NonCorporate.org, Dil Green was an architect and builder for 30 years, working on projects from an extension to London’s Science Museum to an award-wining eco-surgery. He now works away at systemic leverage points around Governance, Wisdom: Pattern Language, and Economy: the Open Credit Network, . He lives in Brixton and blogs at digital-anthropology.

A Director at Lowimpact.org and NonCorporate.org, Dil Green was an architect and builder for 30 years, working on projects from an extension to London’s Science Museum to an award-wining eco-surgery. He now works away at systemic leverage points around Governance, Wisdom: Pattern Language, and Economy: the Open Credit Network, . He lives in Brixton and blogs at digital-anthropology.

2 Comments

Hi Dil. Although your writing style is very coherent, I can’t say I’m any the wiser regarding the more technical aspects of the mutual credit system beyond what I’d expect to happen in a ledger type system.

Presumably, the value of what is being traded is floating so in a sense is dependent on a prevailing market rate with the value of credits tied to hard money, i. E there is a currency relationship.

My sense is that there is overlaps between mutual credit and derivatives

https://en.m.wikipedia.org/wiki/Derivative_(finance) and in particular exchange traded derivatives with mutual credit clubs acting as clearing houses. https://en.m.wikipedia.org/wiki/Exchange-traded_derivative_contract

I have scant understanding of derivatives so I might be completely wrong. However, if a derivative is a contract between two or more parties whose value is based on an agreed-upon underlying asset, with the asset being the mutual credit unit, then it doesn’t seem that different to the idea of exchanging assets with use credit obligations factored in to maintain the velocity of the units within the system.

https://en.m.wikipedia.org/wiki/Velocity_of_money

Do you have derivative experts within the organisation or am I barking up the wrong tree?

Hi Steve.

No, mutual credit is just a record of who’s done what for whom in a community. See https://www.lowimpact.org/categories/mutual-credit

Use-credit obligaitions can be issued by providers of energy, housing, food or any other resource, at a discount, in order to obtain funds for new infrastructure (or to maintain existing infrastructure) without going into debt or giving away equity. See https://www.lowimpact.org/posts/saving-investment-mutual-credit-world