This is part 2 of a conversation with Brett Scott, author and specialist in the money system. Here’s his excellent YouTube channel, and I’ll add links to other things we talk about as well. Part 1 is here.

This is part of a series of interviews that will accompany a book I’m writing about building a new kind of economy, that will be published by Chelsea Green – an employee-owned company, and part of the new economy that the book is describing, built around a mutual credit core. [Here’s more on the book deal and here’s some introductory information about mutual credit.]

Here’s a question, although it might be a bit too binary for you. Can the money system be reformed, or do we have to start building something different?

There are movements that try to do monetary reform. You mentioned Positive Money. They’re a group trying to target the banking sector issuance of money. That idea’s been around for a long time – to curtail the ability of banks to create money. But there are also movements like MMT (modern monetary theory) in the US especially, who target the state money system, who say that we can take democratic control, and stop speaking of money as if it were some kind of constrained commodity. We can talk about the actual power dynamics. So there are movements that are trying to target that, but if your objective is to build a post-capitalist economy, you’re not necessarily going to do it through the standard capitalist money system. A lot of the more peripheral experimentation is looking to the future, but if your experience is as a single working mother, where you’re treated like crap, and the government refuses to acknowledge your struggles, then something like MMT comes along and says that we recognise your problems and we’re going to use the tools of this system to help you, that’s something empowering, although it isn’t going to alter the structure of the economy.

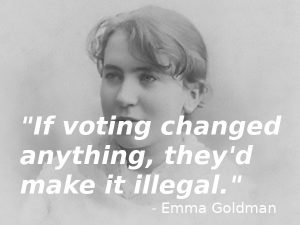

Also, if someone like Bernie Sanders or Alexandra Ocasio Cortez comes along and says we’re introducing MMT – it’s just the impermanence of it. When they lose the next election, it’s going to be reversed.

It’s impermanent but it’s very large-scale. In any alternative economy movement, you have trade-offs. The more profound the change you want to make, the smaller the scale you have to operate on, because you’re going against the grain. But if you want a big political hit, you go to the centre – but of course, it can be reversed. But I don’t think it’s mutually-exclusive. I think that a lot of people who work in monetary reform would also tend to support attempts at building alternatives. I know people in the MMT movement, for example, who are very interested in credit-based, local currency systems.

Yes. It just seems to me sometimes that the reform approach is just prolonging the agony though – making things more bearable so this system lasts longer.

I guess that in a way they shouldn’t be seen as antagonistic. While plenty of people are pouring their energy into building genuine alternatives, there will be others, who can see that the monetary system is under the control of standard, hawkish conservatives, and want to do something about that. There’s always going to be people going in different directions, because they can see different tasks to be done. That’s the case with a lot of MMT people – they don’t want to leave this system to the people who are in control of it. But you’re right, ultimately.

Also, the people building the genuine alternatives – they haven’t been too successful either – the LETS systems, the local currencies, the crypto people. They haven’t changed the world either – they’ve been marginal.

Sure. Let’s say the salvation narrative right now, as far as I can detect (and I’m stuck between the tech community and the financial reform community, so I might getting a biased story), is around things like mutual credit for example – based on strong, sound monetary principles, but historically they’ve stagnated and been hard to start. Something like Bitcoin is based on pretty crap monetary principles, but it’s easy to sell to people. It doesn’t particularly do anything except make some speculators rich, and it does have some peripheral use-cases apart from speculation, but the main reason it’s been successful is that it doesn’t really challenge people’s mentality around money that much. People have seen that crypto has done well from a marketing angle, whereas traditional local currencies, that might be more profound from a monetary perspective, haven’t done that well, but are more interesting. And potentially there’s a zone in which hybridisation might be interesting – for example the use of technology to start scaling up mutual credit. This is where the imagination is currently drifting – could there be some tech, hybrid thing that emerges, to start to enable people to build out mutual credit in a way that wasn’t previously easy to do. That’s where some of the hope lies.

That’s what we’re developing with Mutual Credit Services. We have a package to give to a local ‘club’, and Matthew’s Credit Commons software can link them all together. So it’s there – it’s just getting people to use it, which is the hardest thing. Building tech is relatively easy compared to changing people’s habits.

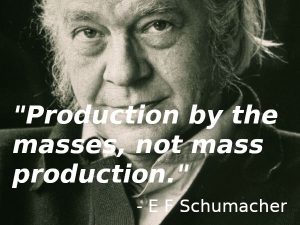

I guess the localist, mutual credit community has always been better at engaging at ground level. Bitcoin, for example – there’s very little evidence of Bitcoin usage at the street level. It exists mainly in an abstract realm. With mutual credit systems, people have gone out and tried to recruit people – it’s a communitarian way of thinking. If you can have enough local nodes, you can start to link them together to build a grounded, embedded, organic coherence. Bitcoin is very inorganic – like a sculpture in space – hovering, with people looking at it – inert. Not really embedded in human economies. But mutual credit is much more about networking groups of real people.

We’re looking for existing networks that already trade with each other, and giving them a tool to trade with each other without money, when money is scarce.

Exactly. This is why they’re harder to build. Bitcoin looks interesting, but it doesn’t demand very much from you – people hold it, then maybe let it go. Mutual credit will demand much more in terms of personal responsibility. People actually issue something – they’re part of building the system. It’s much more profound.

It’s about real people in communities, rather than technology. I don’t think changing the payment system is enough. We don’t want an economy that’s still dominated by Amazon, but with a different payment system. Mutual credit seems like it could initiate, incubate and give advantages to community-based businesses. What do you think?

For sure. I’m quite existentialist – what’s the experience like of using stuff? I think the key conceptual hurdle for people is that in the normal money system, money seems like an object that floats around – asset like. I must try to grab it. The negative, liability side is in the banking sector, so we don’t see the other side of money. All the positive units in bank accounts – when you look at the back end, in the banks, there’s a negative mirror image. Bitcoin slips into that kind of mentality easily because it also appears as an asset-like object that floats around. But with mutual credit you have to start imagining yourself as a money issuer rather than a user of objects issued by others. That’s much harder, because you’re the one pushing out these units into a system.

That’s the crucial thing – people think of money as a thing that you can hold in your hand that you can pass around.

And it’s a thing that doesn’t originate from them. It comes from an external place, and you try to grab it and push it around. We can’t see that, so we have a mythology around the object. Bitcoin shares this mythology. The actual reality of money is that it’s underpinned by a huge liability side rather than just an asset side.

I speak with people who I think have got it, and then they ask ‘what if someone finds a way to steal the credits?’ – but that’s like asking at the end of a football game – ‘what if someone comes along and steals the score?’ – it just can’t happen.

There have been interesting examples here – in Berlin, where I am – called Circles. It’s a version of a mutual-credit-type currency – more like a rippling credit system, which is related. A lot of people originally exposed to it came from the crypto community. They see the units, which actually represent promises issued out by individuals. They think of them like asset-like objects, like a bag of groceries. But it’s not like that. There’s an embedded community, that you have to be part of. You can’t just take the objects and try to sell them. That’s the mentality of someone stuck in a mainstream money headspace.

That same mentality makes people think that if they have a big positive balance, then they’re rich. But it doesn’t – because if you have a large negative balance, that means that you’ve used lots of things from your community.

Exactly. I was speaking with someone in this kind of world recently, who told me that people don’t like the idea of negative credit. They associate it with monetary debt. But the way I frame it is that it’s a form of power. You are issuing out promises, that are being registered in your account as a negative number – but that’s a positive emanation from you. You’re pushing stuff into the system and getting useful things back. Whereas in the standard monetary thinking, when you imagine yourself as a squirrel-like grabber of money, you always associate a negative balance with badness – I’m in debt, and that’s a bad thing. But it’s not like that when we’re all enmeshed with each other.

So you see that real, lasting change will be organic and at the human scale. So for you, mutual credit is part of a package for building something better. But you also like the idea of hybrid things, not black and white solutions. What else do you think will be an important part of the package?

The reason I think hybrid schemes are important is because of the scale of the economy now is huge. Take my phone – it’s an object that can’t exist unless you’re drawing on labour pools from 40 different countries. It’s got cobalt from the DRC, assembled in China – there’s a whole array of different currency networks involved in producing an object like that, and the big trade-off is that local groups have more autonomy, but less access to global goods. Ideally, this will be resolved in the mutual credit world by linking together all the networks. But in reality, much as I’d like that to happen, you’re probably going to have to deal with the large-scale finance system.

Yes, it’s going to be a long time before we can buy smartphones with mutual credit.

Exactly. On the one hand, mutual credit serves communities in economic hardship. It’s very pragmatic – not just idealist. When small businesses lack access to bank credit, they can get together and provide credit to each other. That’s not just a utopian dream, it’s an actual useful thing. But the reality is that when banks decide they want to turn the credit back on, they can disrupt those kinds of networks. So I guess the mutual credit movement should be trying – and is trying – to slowly embed itself and get people more used to it, to provide a counter-power to a much larger system.

Which is more or less how capitalism developed from feudalism. It didn’t confront feudalism or try to reform it. They just built things at the edges and slowly moved to the centre.

Yes. And of course right now with Covid – on the one hand there’s been a negative side to it, with the concentration of power in companies like Amazon. But at the same time Amazon isn’t going to resolve the problem of large-scale unemployment and the breakdown of small businesses. They’re having a temporary win at the moment, but only at the expense of cracking the foundations of the economic system. I think there’s a big opportunity for robust alternatives to come in and offer real solutions. Amazon try to tell us that they’re convenient and can get all these goods to you – but if you’ve lost your job and your local economy is breaking down, you’re not going to care about the convenience offered by some mega-corporation. You want actual income and livelihood.

I guess there are going to be lots of people with redundancy payments, looking for things to do.

Yeah. I think there’s a lot that can be done at this time – building resilience.

One last mad question. If you had a magic wand, and it wasn’t too crazy, what would you ask for?

This goes beyond monetary systems, but I think it would have an interesting effect. I’d ask for people to be able to understand and hold in their heads, contradiction. When I look at the world and see right-wingers fighting left-wingers, and these toxic battles, I feel that if we were able to hold in our heads the idea that there are contradictory forces in the world, we might be a lot more empathic towards one another. From that point, having more hybridised economic systems could be useful too.

I think that’s a fantastic wish. I think social media makes it unlikely. Everyone’s in their bubble, hating on the left or hating on the right.

Yeah. But I think that if we could do it, it would be very helpful, and it would have spin-offs into other areas too.

Thanks Brett. Any questions you have for Brett – please post them on the blog, or on YouTube – but they’ll have a better chance of being answered on the blog. If you want to follow more interviews in this series, subscribe to the blog and / or the YouTube channel.

Thanks Dave – look forward to seeing what happens.

Highlights

- The more profound the change you want to make, the smaller the scale you have to operate on, because you’re going against the grain.

- The salvation narrative right now, as far as I can detect (and I’m stuck between the tech community and the financial reform community, so I might getting a biased story), is around things like mutual credit for example – based on strong, sound monetary principles, but historically they’ve stagnated and been hard to start.

- This is where the imagination is currently drifting – could there be some tech, hybrid thing that emerges, to start to enable people to build out mutual credit in a way that wasn’t previously easy to do. That’s where some of the hope lies.

- I guess the mutual credit movement should be trying – and is trying – to slowly embed itself and get people more used to it, to provide a counter-power to a much larger system.