The Money & Society MOOC was launched by Matthew Slater and Jem Bendell in 2014. In four dense but perfectly assimilable 2-hour videos, it blows open your understanding of economics, in an incredibly liberating and empowering way.

By ignoring most of what is taught as economics, and going directly to the root — money.

For most economists, and essentially all economics textbooks, money is just that — money: inevitable, obvious, as if it were water, or gravity — part of the basic structure of the world. All of its characteristics — issuance by a central authority, its operation as simultaneously information, purchasing power and a storable commodity, its relation to debt and interest — none of these things are examined, but instead taken for granted, assumed — natural.

Of course, everyone knows that this is untrue. Everyone has had some version of the conversation in their teens, their twenties, and many times thereafter, where we say to each other — but these are just bits of paper! How crazy is that? These conversations, though, typically go nowhere — we shrug our shoulders, roll our eyes, maybe argue, get angry a bit. But in the end, money may as well be physics — however much we know that it isn’t. Have none, you end up helpless, hungry and probably homeless, and there you are — why argue with physics?

We get on with our lives, and simply allow something unexamined to constrain every aspect of how we do so. Think for a moment, and try to come up with an aspect of your life that has not been conditioned by scarcity of money (and then include the knowledge of the possibility of scarcity, and see what you are left with).

The MOOC can change this — not the constraint, perhaps, but the unexamined character of that constraint — and without taking you into some bizarre world of cranky currency obsessives either. I did the course at the end of 2017, and then was in a discussion group with others who were going through it in 2018. Truly, it helped me to think about economics in a way that felt empowering and surefooted for the first time in a lifetime of knowing that the economic system was a key driver of the mess our civilisation is making of the world.

To realise that almost all of the stuff that is taught as ‘economics’ — the ‘dismal science’ that tells you, sure, you can have hopes, dreams, ideals, ethics, but that in the end, none of these matter, because ‘this is the way the world really works’ — all of that is built on a set of assumptions about the particular characteristics of the type of money that we use, and all of that is contingent upon some basic design choices. Design choices which, far from being inevitable, have not even been consciously made, but simply accepted, even as they have evolved. The economics we have is just the economics of a particular form of money. A blatant myopia masquerading increasingly as an explanation of everything we do.

Our economic system has co-evolved with our money in a blind dance that sees them fit each other very well, but which has no more connection with the deep purpose and meaning of an economy* that does the mating dance of certain species of birds have with the essence of being a bird.

It’s a textbook example of a ‘sexual selection spiral’ — a ‘Fisherian runaway’ (no, me neither, until just now — but it is). What this describes is the mechanism whereby, as a change on one side of a co-dependent evolutionary relationship is (even accidentally) selected for as a ‘choice’ on the other side, it gets emphasised. And as this sets up an exaggerated expectation on the choosing side, a powerful positive feedback loop can set in. This is what powers some of the most bizarre and clearly resilience-reducing mating rituals we see, among other things — such as orchid/insect specificity.

Such instances are recognised as ‘extreme and apparently maladaptive…’ — it is clear that the observable characteristics of the co-evolved partners are only loosely tied to the key markers of ‘fitness’ in the context.

But hang on, you might say — this is what makes peacock feathers and Bird-of-Paradise dances. What’s so bad about those?

And the answer, of course, is nothing — but look at the context. These are a few of many thousands of bird species. The biosphere has many specific niches (well, fewer and fewer, but we’ll get to that), and, if evolution can be said to have a project, it is to maintain diversity for maximum resilience in the face of a radically uncertain future. In some futures, perhaps peacocks have exactly the optimal survival strategy, in which case life on Earth will have prepared well.

And that’s the point; the money systems humans have used across history have been wildly diverse, and deeply context specific — until now. Increasingly over the last 150 years, and at a fitfully accelerating pace, all variety, all diversity is being ironed out of the world financial system.

The dollar, the euro and the renminbi are essentially the only currencies that matter, and the manner of their operation is essentially the same. The number of institutions that issue currency, and their uniformity of operation has also radically diminished over the last decades, the variety of policy levers that seem viable at a macro level (and there is nothing but macro, really, any more) have come down, basically, to two; interest rates and printing more dollars to throw at the rich — and interest rates are pretty much a busted flush. There is one global forex market. It is as if we are replacing all birds with peacocks.

Is it any wonder that money serves so much of humanity so poorly? Sure, we get the Falcon 9 rocket, we get the Burj al Arab, we get superyachts and blockbuster movies, but these are bling, like peacock feathers, while the rest of the system has no access to anything like this, as inequality measures spiral beyond our capacity to even make sense of them.

Those who preach evolution as determinism might argue back — look at the number of people ‘raised out of poverty’ through globalisation. That these critiques, however evidence-based, are ‘oughts’, are moralising — and that there is simply no point in moralising about evolution: it will do what it will do, and in the service of the ‘fittest’ outcome, however we might protest — and that we can’t do any better.

These might be powerful arguments — if any of them had any purchase on the fabric of reality.

In reality, as Jason Hickel so powerfully argues, the measures of poverty reduction are highly tendentious. At the same time, the financial system is unarguably increasingly fragile, increasingly vulnerable to external shocks — like Covid-19, and at the same time increasingly prone to creating its own shocks — shocks which have nothing whatsoever to do with real-world conditions, which are entirely endogenous. Even in their own terms, the arguments of the evolutionary determinists are flawed.

But still, they are arguments — they go back and forth, and perhaps there is no clear and final resolution. The point, though, is that all of this is by-the-bye. These are arguments among peacocks as to how peacockism works for peacocks (all fine-and-dandy — the stuff of life; keeps us all interested and entertained. Shut up and enjoy the show!).

Peacockism, however, relies completely upon a context — the environment in which peacocks live and have their being. If the variety of peacockism in favour, that obsesses and absorbs peacocks so intensely, should happen to destroy the environment in which peacocks live, then the game is over. No more pretty feathers, elaborate dances, no more Burj al Arabs or space rockets or Brad Pitts. Quite probably no more complex machinery, or even perhaps pots to cook in, depending on the degree of warming our peacockery engenders.

And clearly, this is the situation we are in. Our economy, whatever the morality of it, whatever the outcomes we desire of it, which we celebrate, which we denigrate, however we argue about it, whatever the colour of our tails, or of our politics, is simplifying the biosphere — reducing its diversity, gradually seeking to convert all ecosystem niches into the service of building larger piles of dollars. We have already invented the paperclip maximiser, and it is already eating the planet. Luckily, it isn’t an AI, and will be unable to transcend its own death spiral, so we haven’t condemned the universe to this fate.

And this is where the empowering qualities of the MOOC come in. Once you get the point that the design of money systems is, in fact, relatively simple at bottom, with a very few choices as to key characteristics, all of the bewildering complexity of economics, of macro- and micro-, of derivatives and credit-default-swaps falls away, revealed as having no more deep import than the frills on the edge of a peacock feather, as artefacts of a system which can clearly be seen as sub-optimal.

Basically, dumb. So utterly dumb, in fact (and systemically cruel, too), that as soon as you see it, you think; Let’s stop.

Let’s. Just. Stop.

Surely, anything would be better than this?

But of course, you’d be wrong. Peacocks can’t just stop being peacocks. Unless they all die. Which is, of course, very much on the table if we get much past 3 degrees of warming. But let’s not start disempowering ourselves again (and we’ll get to this later, too).

The only way out for us is to consciously design an evolutionary pathway out of this mess. Devise, as it were, mating incentives for peacocks that gradually de-emphasise remarkable tail feathers and enforce more systemically positive fitness characteristics.

Tall order, you might think. Above my pay grade.

Certainly above mine. But it turns out that, all along, there have been people thinking these thoughts, doing this work, analysing different pathways. Even better, there are a few small ecological niches in which alternate approaches have been sustaining themselves, and growing. We haven’t heard much of these, because, of course, we’re conditioned to look for peacock tails, and these places don’t do bling, so much as steady, resilient, collaborative wealth and capacity building.

Economic thinkers like EC Riegel and WB Green, Bernard Lietaer and Thomas Greco, among others have developed varieties of designs that bring the issuance of money into its optimal place — with the producers of value who can issue credit with a clear promise of redemption against future production, and optimal condition — that of pure information as to a promise, without any commodity character or associated debt burden.

This approach to money is generally known as Mutual Credit. It offers a model for an economy with a natural approximate sufficiency of money — not too much, or too little, but closely coupled to the evident productive capacity of the participants. An economy without banks at the centre, with all the perverse incentives, power concentration and attendant fragility that brings, a world where economic regulation is in the service of human desires, rather than making piles of dollar symbols.

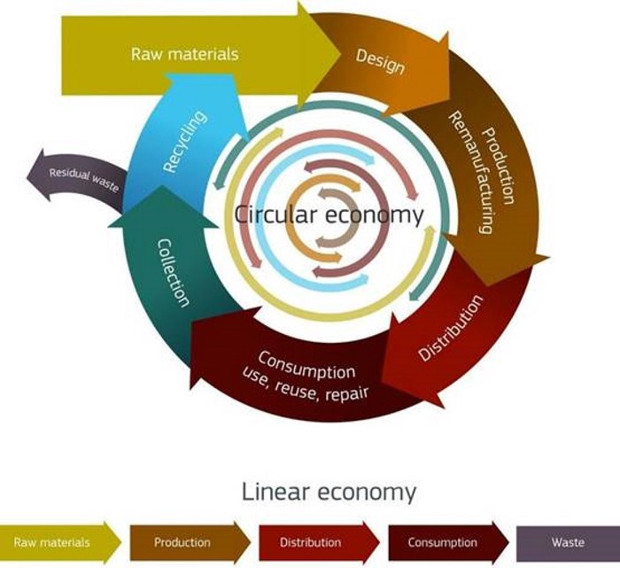

That’s about the elimination of negatives, but there are also clear systemic positives. Mutual Credit de-emphasises the importance of the means of exchange — the numbers, and re-emphasises the value provided — the human-value that is built by the exchange. More immediately, it rewards ‘circularity’ of trade — the more credit can be issued and redeemed within a relatively local network — the more ‘circular’ the local economy — the more value everyone experiences. This tends to support circular economy models with the emphasis on adding real value, as opposed to linear economics where the goods being traded become an increasingly hot potato as they get towards the consumption end — to be moved on as fast as possible — even if that means straight to the dump.

We see Mutual Credit as a means-of-exchange that eliminates a wide range of perverse incentives in trade, and which introduces positive ones in their place. A money system which values growth in human capacity over growth in consumption. In short, a money system which encourages bottom-up qualities which are less extractive, less wasteful, less resource intensive and more closely tied to real human desires than to manufactured ‘consumer demand’.

There’s a great deal more that could be said in this vein, but that’s enough for this post. It’s also important to understand that Mutual Credit is not a replacement for the money we know — there’s no point replacing one monoculture with another. Since Mutual Credit is by design not a reliable ‘store-of-value’, other economic instruments are required as part of a viable ecosystem, and these are also well understood and in prospect— but that’s for another day.

Focusing back in onto Mutual Credit, there are viable operational networks all over the world — thousands of small-scale, p2p LETS schemes, many hundreds of commercial networks, and some significant heavyweights, like the WIR in Switzerland and Sardex in Italy.

Beyond these, there is the vision of a global federation of such networks, allowing trade worldwide without reliance on bank-issued money, as set out in the Credit Commons whitepaper, co-authored by Matthew Slater of the MOOC and Tim Jenkin, a long-time Mutual Credit network builder (not to mention heroic ANC activist and subject of the recently released film Escape from Pretoria).

It was this vision that inspired me, Dave and Oli to start what became the Open Credit Network in 2018. We set out to build and grow to viability the first fully mutual, fully open-source powered B2B mutual credit network, as a baseboard from which to build out to a global Credit Commons. In January this year, we launched with brand new software, and now have over 70 members with trading status.

And then came Covid-19. Quite apart from its grim impact on health, it became clear, once lockdowns spread across the world, that there was going to be a significant economic impact — impact that, once again, was going to disproportionately impact the poor and the disadvantaged — those who will not be bailed out like the big corporations, banks and hedge funds.

Stock markets are holding up just fine, while unemployment figures shoot up at unprecedented rates. There will be a recession — maybe a depression, and it will entirely be driven by a shortage of money (not of capacity, or of needs).

We realised that, if Mutual Credit does what we think it does, and if we understand it as we think we do, then we have a duty here (and an opportunity — ‘disaster mutualism’, perhaps?) to offer it as widely as we can, at the maximum scale we can, to support small businesses through this crash.

Mutual Credit Clubs — our post-Covid initiative — is now working with a broad group of dynamic collaborators (this isn’t marketing speak, this is genuinely how it’s going) on strategies for launching new networks in the context of the UK Social Enterprise and Municipal sectors, as well as new initiatives for SMEs.

Very soon (within months), we will have software that makes the Credit Commons promise real — the capacity to federate these networks together for greater diversity and resilience, and realise the network effects that power economies. Rapidly, this will enable us to connect together other networks -existing and new — across the world.

If this intrigues you, even a little, then firstly, I would urge you to go through the MOOC — to experience for yourself the liberation that comes from seeing how money really works.

Beyond that — if you are inspired by the MOOC to help build in this area, then do get in touch. We are particularly in need of all sorts of people, network builders, economists, computational modellers, communicators, video makers, designers — people who want to make things happen.

* The ‘purpose of an economy’, as I see it, is ‘to facilitate co-ordination between outgroups, in the service of maximum ability for humans at all levels of grouping to specialise (another way of saying this — ‘fulfil their essence duty’) — and thereby build civilisation’. Yes, that is dense, and yes, I will unpack it somewhere else, at some point.

About the author: Dil Green is co-founder of the Open Credit Network, who are building a mutual credit network for the UK; He’s also a member of the Lowimpact.org co-op, and is a vocational architect and designer. He’s a pragmatic utopian who thinks the he perfect world will (should) never exist, but we must never stop working towards it. He values kindness between beings, and ruthlessness in regard to institutions.

About the author: Dil Green is co-founder of the Open Credit Network, who are building a mutual credit network for the UK; He’s also a member of the Lowimpact.org co-op, and is a vocational architect and designer. He’s a pragmatic utopian who thinks the he perfect world will (should) never exist, but we must never stop working towards it. He values kindness between beings, and ruthlessness in regard to institutions.

2 Comments

Dil, can you or anybody help me?? At farmers’ markets lately, there is huge pressure to take card payments rather than cash, as being less likely to spread Covid. I am explaining to people that they can always write me a cheque if they haven’t got cash; and they all seem to think it is because of my great age that I don’t go down the easy and convenient contactless route. Sometimes I can quickly manage to say that I don’t like to give more power to the banks; but I haven’t got a ready or quick explanation of how this works. Can you fill me in?

Actually, cash is more useful to me, as being instantly usable, rather than my having to wait for it to clear, visit a Post Office bank branch, cash machine etc.

Best wishes and namaste

Hilary

Brett Scott is good on this – https://www.theguardian.com/commentisfree/2018/jul/19/cashless-society-con-big-finance-banks-closing-atms

… and he talks about Covid specifically here – https://www.resilience.org/stories/2020-06-22/cash-kisses-and-karaoke-why-the-war-on-covid-must-not-become-a-war-on-cash/

.. and the German Bundesbank says that there’s no particular risk of infection from cash – https://www.bundesbank.de/en/tasks/topics/cash-poses-no-particular-risk-of-infection-for-public-828762