It seems pretty obvious that there’s a giant economic slump on the way that’s going to sweep away millions of small and medium-sized businesses around the world, so that Amazon can step in to continue to try to take over the entire global economy.

I attended a wonderful online presentation on Friday, attended by around 80 key people working in the field of monetary reform, that showed how we can counter this trend, and keep small businesses alive.

There’s going to be a huge scarcity of money in communities for small businesses, and banks aren’t interested in lending to them – too much admin and risk, not enough profit.

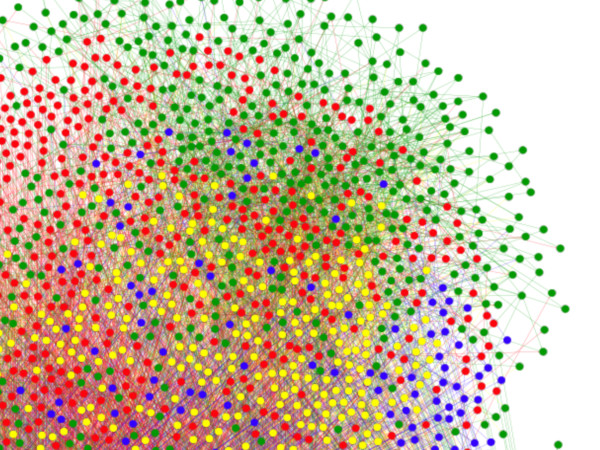

I’ve blogged about mutual credit here many times, as a way to allow small businesses to trade with each other without requiring money. Now research has been carried out that looks at data from transactions totalling millions of euros between thousands of small businesses, and that provides the evidence that we’ve been looking for. It shows that businesses can reduce the need for cash by 25% by using mutual credit, and by another 25% by using something called continuous clearing. I’ll explain that now.

Continuous clearing

Imagine that at the end of the month, a circular trading loop of 10 businesses each owe £5000 to the next business in the loop. In normal business practice, 10 invoices are waiting to be paid, but none of the businesses knows the full story, and so they don’t realise that if they did see the whole picture, all those debts could be cleared without making any payments. Imagine that there’s a recession, and none of them has any spare cash. Some of them might arrange overdrafts so that they can pay – or worse, take out an expensive loan; or worse still, all the businesses might do the same thing. Then there’s interest to pay to the bank or the loan company, as well as the usual bank charges. ‘Trade credit clubs’ provide the solution to this problem. No-one needs an overdraft or a loan, no-one owes anybody anything, cashflow problems are eased, the banks don’t get any interest, and with a bit of luck, a few payday loan companies go out of business.

Businesses are already familiar with trade credit, and it’s much more common and more useful to small businesses than bank loans when it comes to providing ongoing liquidity. Most business-to-business invoices include payment terms of 30, and sometimes up to 90 days. This is quite risky for small businesses – but coming together in a trade credit club can reduce that risk drastically. Imagine a small club of three businesses (there could be a hundred businesses in a club, but for simplicity’s sake, let’s say there are just three). Business A buys something from business B for £10; Business B buys something from business C for £15; and business C buys something from business A for £5. But – instead of actually making those payments, they send the invoice details to a convener (or any trusted third party) to be ‘continuously cleared’, (which is is exactly what happens between banks).

So in this case, the convener can see that business A owes £10 and is due £5, so overall, owes £5 to the club; business B owes £15 and is due £10, so owes the club £5; and business C owes £5 and is due £15, so overall, is owed £10 from the club. The convener ‘clears’ those invoices and works out how each business’s balance changes, and then (maybe at the end of the month, or any time period agreed by the club members), instructs business A and business B to pay £5 each to business C, and everyone is square. So in this simple case, instead of three transactions totalling £30, there are just two transactions totalling £10. But, the interesting thing is that if there had been hundreds of transactions totalling hundreds of thousands of pounds, it might still have ended up with just a few payments of around £10 in total to bring everyone back to zero. This system drastically reduces the number of payments required, as well as the amount of cash that each business needs to enable all their transactions. It helps massively with cashflow and drastically reduces admin and bank charges.

Additionally, at the end of the month, the club might decide that, within limits, they won’t even bother making cash payments at all. So in the example above, business A and business B will both have a balance in their account of -5 units, and business C will have a balance of +10 units – which means that this is now also a mutual credit system. If someone is up or down by a huge amount, there might be an agreement to make a cash payment to bring them back to within pre-agreed limits (i.e. the mutual credit debit or credit limits). So for a club of businesses that trade with each other a lot, this is a double whammy – continuous clearing and mutual credit together could mean that they have no bank charges, no cashflow problems, no overdraft requirements, and possibly no cash payments to make at all.

The continuous clearing aspect is much easier for businesses to understand because it’s just common sense really – especially in a time when there’s not much cash around. The mutual credit part is a beneficial add-on, but in time, if it works well, the club could treat the continuous clearing as a warm-up act for mutual credit – like having stabilisers on a bicycle when you’re learning to ride. They could take off the stabilisers and become a dedicated mutual credit club if they want to.

The research

Here’s the paper. It’s quite heavy going, so here’s a summary:

There’s a pretty incredible addition to the trade credit story, and it’s that one country – Slovenia – has been operating what is in effect a giant, nation-wide trade credit club for over 30 years, with remarkable results. After independence in 1991 was immediately followed by a war against the Yugoslav army, and with inflation at more than 200%, the Slovenian economy wasn’t in good shape. To help protect Slovenian businesses, the government set up a system whereby businesses could send invoices for trades internal to Slovenia, to be cleared by the state payments agency. In the first year, the system resulted in a saving of cash payments by small businesses representing around 7.5% of the entire economy. Since then the proportion has fallen during good times, and grown again during slumps, which is to be expected. Slovenia has a small internal market; most of its firms are geared towards exports, and therefore can’t take part in national credit clearing. A bigger country with a larger internal market could achieve even more impressive results. This system helped Slovenia through the post-2008 slump without losing small businesses. Note that they don’t use mutual credit however – just continuous clearing.

In November 2020, Tomaž Fleischman of Slovenian software company Be Solutions, together with Paolo Dini of the LSE and Guiseppe Littera of Sardex, produced an academic paper investigating the benefits in terms of cash-saving for small business of a combination of continuous clearing (or obligation clearing as they call it) and mutual credit. They used Tetris software developed by Be Solutions to analyse almost 140,000 transactions totalling over 30 million euros between more than 3000 businesses. What they found was incredible – that continuous clearing alone can reduce the need for hard currency by 25%, but in combination with mutual credit, another 25% saving can be achieved. So these two mechanisms together can mean that 50% of the turnover of a typical small businesses can be conducted without the need for cash. This provides evidence to confirm one of our main assumptions about mutual credit (and credit clearing) – that it can keep small businesses alive during times of economic hardship, when money is scarce. Of course the continuous clearing doesn’t have to be carried out by the government – it can be provided at the local level, for example as part of a trade credit package offered by MCS.

Tomaž has since read the Credit Commons white paper, and is very interested in the possibility of global federation.

This research is quite a leap forward for what we’re trying to do with Mutual Credit Services. Any business network or local authority with vision should be able to see that they could help reduce the cash requirements of the small businesses in their network or local area by up to 50%! Hopefully we can help to set up Trade Credit Clubs around the UK and overseas (one of our team is talking to local authorities in the Czech Republic, and we’re in contact with groups on every continent).

Here’s an introduction to mutual credit, and here’s more on a book that’s coming out early next year. I’ll see if I can arrange an interview with Tomaž soon.

About the author: Dave Darby lived at Redfield community from 1996 to 2009. Working on development projects in Romania, he realised they saw Western countries as role models, so decided to try to bring about change in the UK instead. He founded Lowimpact.org in 2001, spent 3 years on the board of the Ecological Land Co-op and was a founder of NonCorporate.org. and the Open Credit Network.

About the author: Dave Darby lived at Redfield community from 1996 to 2009. Working on development projects in Romania, he realised they saw Western countries as role models, so decided to try to bring about change in the UK instead. He founded Lowimpact.org in 2001, spent 3 years on the board of the Ecological Land Co-op and was a founder of NonCorporate.org. and the Open Credit Network.

5 Comments

Nice information! can’t wait to see this in action. I have one or two questions about mutual credit. Would it be possible to have a business that is a chain and is part of a mutual credit system?. How would international trade look in such a system?

6degrees

It’s possible but unlikely. As the business model of multinationals is to extract wealth from communities and deliver it to shareholders / tax havens, and mutual credit makes that very difficult, I think they’re more likely to oppose it than support it. (but continuous clearing at the national level, as in Slovenia, can be used by any sized business in the country).

Local groups are linked to regional groups, then national networks, continental networks – up to the global level, in the ‘Credit Commons’ – http://www.creditcommons.net/ – so that businesses anywhere can trade seamlessly.

Thank you! know I can see how it would be able to do trade internationally. Maybe a chain with individual components all responding to a overhead co-op leadership? I’ve got only one more question. If developed nations like Britain suddenly go into a mutual development world wouldn’t governmental aid cease as governments don’t make money through tax (or did I misunderstand)?

-6degrees

6degrees

International trade in mutual credit would be possible via a global Credit Commons. See this interview for more info – https://www.lowimpact.org/building-the-credit-commons-with-mutual-credit-clubs-matthew-slater/.

The mutual credit sector would be built (is being built) slowly – taxes will still be payable in legal tender. And mutual credit transactions are taxable in legal tender equivalent. Some local authorities could join (and convene) their local mutual credit club, and potentially accept local taxes in mutual credit units. We’ll have to wait and see if states follow suit at some point. Depends on whether they see mutual credit clubs and the credit commons as beneficial, or whether they’d take the side of banks. I’m guessing the latter for now. When Slovenia joined the EU, the EU tried to pressure them to close down their obligation clearing programme, but they resisted, and it continues.

thanks Dave,

I guess that makes sense. I can see how tax would now work (the Mutual credit system could also sell a product tax to pay for collective tax). I would be somewhat worried if states took mutual credit units that it would dissolve back into corporate money. A currency between systems would be great though! Would we still have World Wide Web or just smaller systems? (I’m not sure I want to give up the convenience and knowledge of the internet).