In this interview I’m talking with Michael Hallam, who is involved with the Ethical Small Traders Association (ESTA) in Lancaster, and has recently been working with Mutual Credit Services on a credit clearing project called Local Loop Lancaster & Morecambe. Credit clearing is an important part of what needs to happen to build a new, ‘commons’ economy, so I wanted to talk with him about his motivations – what problem is he trying to solve, and how is he going about it. Here’s a summary of what we talked about. For more details, see the video below.

Background

The Ethical Small Traders Association started as a support network for local freelancers. We want to create a thriving and sustainable local economy, that helps everyone to reach their full potential as a human being, and helps us all to live within the carrying capacity of the planet – using whatever tools are available to get the job done. The members are now not just freelancers (they’re also businesses, social enterprises, representatives of the council, a handful of academics etc. This includes shops, market stalls, yoga teachers, restaurants, co-ops, electricians, graphic designers, a garage etc.), and not just in and around Lancaster (due to the wonders of technology) – for example, they have a member in Kenya, as well as several scattered around the UK.

Michael asks whether 2050 be better than today, or will it be a dystopia? It’s up to all of us to try to move us towards the former and away from the latter. He got into the world of monetary change when he came across the work of Michael Linton in the 1990s, and he helped set up a LETS scheme in Stourbridge in 1993. He realised that although there was lots of trading going on, if you froze the system and added up all the accounts, it came to zero (because accounts in debt always balance out accounts in credit). It seemed like magic. But it was only after 2008 that interest really grew in these alternative schemes, because before that there was so much cheap debt around.

So he became interested in alternatives again after 2008, when everyone was trying to set up local currencies – although he didn’t think that was the answer (and has since been proven right). He believes (and so do I) that we’ve given away our tools to the banking system, when all we have to do is to provide credit to ourselves in communities. There’s no need for a medium of exchange – just the provision of goods and services between ourselves in communities, and a way of accounting for it.

Credit Clearing

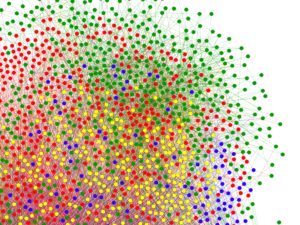

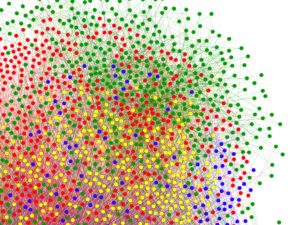

Michael has been involved in building a platform that allows businesses / traders to track their supply chains, to identify where those chains loop back on themselves to form closed loops. Within any loop, there will be an amount of money that will be passing through everybody’s hands, that can be ‘cleared’.

Put simply, if A owes B £100, B owes C £100 and C owes A £100, then that £100 doesn’t actually need to change hands – the debt can be cancelled out, or cleared. For more information on the magic of credit clearing, see our topic introduction.

This clearing can help small traders to overcome their cashflow problems, and as less money needs to change hands, this can reduce bank charges; plus it can break supply chain gridlocks – it can solve the late payment problem that lots of small businesses have, i.e. waiting to be paid by someone, so that they can pay someone else.

If there’s a tight local economy with lots of loops, it can dramatically reduce the need for cash.

Also, you if you have the data on all these local loops, you can start to identify gaps, that could be filled to make more loops, by inviting in businesses to provide goods and services that are needed within the network. You can start to actively build the local economy – something that Preston council down the road is very big on, with their ‘Preston Model’ of Community Wealth Building.

Local Loop Lancaster & Morecambe

This is the first project of its type in the UK. They’re working with Mutual Credit Services, and the loop-finding software is provided by Tomaž Fleischman and his team. In Slovenia, prior to the fall of communism in the early 1990s, businesses were used to sending copies of invoices to the government, so that they could keep tabs on what was happening in the economy. This practice was continued after independence in 1992, and businesses were used to it. The government was able to find loops and clear a lot of the debt that Slovenian businesses had with each other – keeping a lot of them alive in times of great hardship (competition from Western businesses, war, recession etc.). More information here.

The most successful example of credit clearing is between banks. Banks clear debts between themselves constantly, rather than having to pay each other for every transaction between customers of different banks. In Lancaster, they can see that if banks do it, it must work, and so they want to use those tools for the benefit of the community.

They’re talking with Preston council, and hope to collaborate more when things are more established. They’re looking to link up the Lancaster, Preston and Kendal areas, with a view to building a network covering Lancashire and the North West.

They’re recruiting businesses now, and they intend to launch with around 120 members. There’s no real limit to the number of businesses that can join, and in theory, it could cover the entire country. The software allows for a recursive / fractal system that can be embedded in communities, but reach large scale.

Practicalities

Local businesses put their details into an app. Mutual Credit Services are working on automating processes, as British businesses don’t have the habit of sending copies of invoices to a service provider. If information can be collected directly from book-keeping platforms, it can automate things in ways that will speed things up considerably.

In the trial period, data is being collected that can illustrate benefits clearly for local businesses and the local economy. It can begin to open doors to the architecture of the local economy, in terms of goods and services, rather than money – i.e. it shines a light on the real value being generated in communities. No-one else is currently collecting this data.

The local Chamber of Commerce has been very receptive to these ideas. In fact, the Chamber of Commerce will be in the project, and will bring their members with them. Michael says that their local CofC has egalitarian and community-focused ideas – but it would be a coup for any scheme to have the local CofC on board. The Business Improvement Districts in Lancaster and Morecambe are supporting it too, as does the economic development department of the local council. So there’s lots of local support. The biggest barrier may well be human intertia and initial lack of understanding of how it might work and the benefits it could bring.

How do we scale, connect and federate the new economy?

The software and protocols developed by Mutual Credit Services allow for scaling. The potential for scaling is already built into the tools. As for connecting the different aspects of the new economy, first we have to define this new economy. First, it has to be sustainable – and therefore ‘steady-state’. This is a fundamental principle, but there are other elements around that that have to be in place. For example, products should be durable – things shouldn’t break easily, so that they have to be constantly replaced (which increases GDP and makes it appear that the economy is in good shape, when really, it’s in bad shape, because what’s being produced doesn’t last very long). If things last a long time, that’s bad for GDP, which is one reason that GDP is such a bad indicator of human well-being (a more important reason is that GDP growth is the root cause of environmental destruction).

We’ll be interviewing Michael again to see how the project is coming along. Once the penny drops, you see that the potential for change for credit clearing / mutual credit is huge.

If you’d like to be involved, contact them via the website or the app.

Highlights

- clearing can help small traders to overcome their cashflow and late payment problems, and it dramaticallly reduce the need for cash in communities.

- Local Loop Lancaster & Morecambe is the first project of its type in the UK. They’re working with Mutual Credit Services, and the loop-finding software is provided by Tomaž Fleischman and his team.

- The most successful example of credit clearing is between banks. Banks clear debts between themselves constantly, rather than having to pay each other for every transaction.