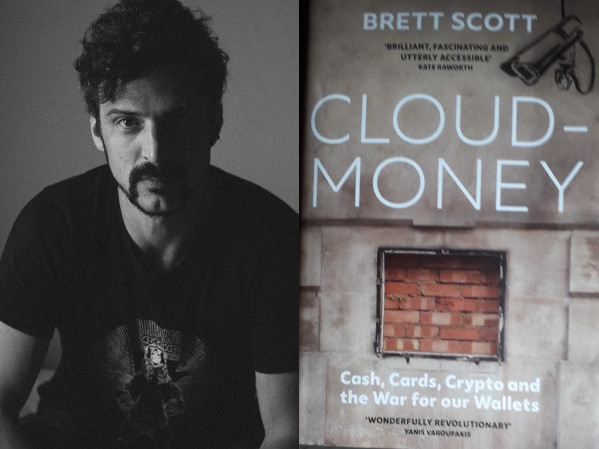

Review of Brett Scott’s ‘Cloud Money’

I’ve been following campaigner and former broker Brett Scott’s excellent articles and videos about money at Altered States of Monetary Consciousness, and I read his Heretic’s Guide to Global Finance: Hacking the Future of Money, (highly recommended if you want to find out more about the workings of and actors in the financial sector) – so I’ve been looking forward to reading this.

“Under the hood (of digital money) we find a convoluted transnational payments circuitry, tied together by institutions you cannot see, but who can see you.”

Dystopia

Cloud Money is the digital money that is being used deliberately to drive out cash, and to make our every transaction known to corporations and the state. Scott bemoans the loss of things like dropping a coin into a busker’s hat and honesty boxes on roadside fruit and veg stalls, replaced by the growth of a global network of corporations and digital payments that superficially looks like competition between different corporations, but is actually a giant supersystem geared for surveillance, data capture and concentration of wealth and power. The state and corporate sector are busy making sure that people are locked into this supersystem, and that alternatives are made more and more difficult. What makes this book so interesting to me is that those alternatives are precisely what we’re promoting at Lowimpact, from growing your own veg, fixing things and installing renewables to co-ops, free software and farmers’ markets – as well as alternative monetary systems – but always via real people, in ways that keep wealth in real communities.

He points out that convenience breeds dependence – but that dependence seems to be a price worth paying for most people. Unfortunately, that leads to a world of massive power concentration. Digital money exists distantly, in the hands of giant financial institutions that are building alliances with giant corporations to oversee and control every aspect of our lives.

The world of tech is of course at the forefront of these developments, and the hype is that ‘the old’ – like bank branches, cash and anything small-scale or non-digital, must be replaced by the new, and that we’ll be doing a favour for the millions of ‘unbanked’ in the world by helping to ‘bank’ them (and, I guess, to Amazon, Microsoft, Google and generally corporatise them too). Those of us who feel uneasy (or sickened) by this are assaulted by ubiquitous advertising warning us that we have to face up to and get ready for this reality, or be ‘left behind’. Personally, I’ll take that – but I see it as ‘stepping aside’ – I don’t feel at all ‘behind’ the technophiles and the marketers – quite the opposite.

I don’t remember asking for any of this, and I never meet anyone who genuinely wants it. So who’s driving it? I don’t really have to answer that, do I? Actually, maybe I do – because it’s not ‘the Illuminati’ or ‘the Jews’ or Bill Gates or ‘Wall Street’ – not any particular individuals or groups at all, in fact, but a symbiotic, state-corporate coalition that rewards giantism and market dominance and forces people into corporate ‘bullshit jobs’ where they have to push innovation in the quest for profits, but will become redundant soon anyway, due to automation. And states know that policies that don’t stimulate growth and favour the corporate sector will cause ‘capital flight’ and their country will fall down the global rankings. Credit rating agencies rate countries based on IMF / World Bank data; if they don’t focus on corporate priorities, they’re downgraded and capital flows out of their country. No-one wants to drop out of the G7 / G20 / GWhatever, in a world where conflict between countries is ultimately resolved with military force. Capitalism has its own momentum, and it’s extremely damaging to community, to nature, to democracy and to human well-being. Even so, as Scott points out, it can be helped along – here’s his recipe:

“Take an oligolopolistic sector of tech giants, whose platforms are fused into the life of billions. Then glue both to everything else (cities, machines, our bodies), and present this situation – in which our entire environment is possessed by the profit motives of distant oligopolies – as an inevitable and welcome revolution driven by us all. Finally, cast anyone who rebels as an irrelevant and out-of-touch Luddite stuck in the past, who needs to be cajoled along, or rescued.”

He says that after his first book, he travelled the world hanging out with groups looking to create havoc in the world of finance, ‘from far-left anarchists and ecological activists to New Age spiritualists, market libertarians, hawkish conservatives and government technocrats.

He’s been to our house, where he hung out with a gang of mutual-credit-geeks – he’s a very nice chap, and his position on most things didn’t seem that far from ours, so I warmed to him immediately; although I don’t know which one of those groups we belong to – anarchists I guess, but not ‘far-left’ (a label that for me brings up images of a lot more state power than I’d like to see). I interview him here and here.

In Cloud Money, he also gives an accessible explanation of where money comes from and the workings of the banking sector and global payment networks. Most people have misunderstandings about these things, often reinforced by economics courses and textbooks. It’s high time we all knew about this. He also tells of many ways in which cloud money facilitates the tracking and monitoring of all of us, by corporations trying to sell us things, by states trying to see if we’re doing something they don’t like, like buying certain books or subscribing to certain websites, and by both, to decide whether to alter your credit score or insurance risk, or to give us access to particular services – including payment systems! Also something that we should all be aware of.

I share his opinion on fintech – in that it’s not at all ‘disrupting’ or threatening to the banking system – it’s far too superficial a gloss on the underlying banking infrastructure, and is in fact strengthening it by speeding up and simplifying transactions. There’s a brewing rebellion to this creeping giantism, surveillance and data harvesting. There are many streams to this rebellion (although ‘anarcho-capitalism’ – an oxymoron – isn’t one of them: something I’ll be blogging more about soon). Probably the best known currently is crypto – but for Brett there’s a problem, in that it’s not a type of money, but a good – a ‘digital collectible’, priced in money; and that the technology is being co-opted by the banking sector, other corporates and the state anyway. For me it also dehumanises, removing the need for trusting and trusted relationships, and although it can decentralise power away from states and banks, there is nothing in the tech to prevent the creation of crypto billionaires – quite the opposite – and so if crypto does decentralise power, it will re-centralise it again somewhere else. But there’s another exchange system in which the exchange medium is not scarce, not controlled by banks, but also, can’t be hoarded and concentrated in the hands of the super-rich, and that system is mutual credit – based on free markets (but without the extractive profits), and anti-corporate (because the size and influence of corporations kills the possibility of truly free markets). We also concur when it comes to the ability or the desire of the state to constrict the power of the corporate sector. A couple of short lines in the book: ‘formal state institutions catalyse bigger markets’ and ‘state power gives rise to corporate power’ seem to an anarchist like me to be the nub of the problem, because it provides, I believe, the biggest barrier to challenging corporate dominance – that is, the belief by well-meaning ‘progressives’ that the state, via their preferred party or politicians, will step up like a knight in shining armour to save the damsel from the dragon. It will not – it will deliver the damsel, stripped and in chains, into the dragon’s lair. Brett says that the US state provides more autonomy to the corporates than the Chinese state. Sure, but it provides just as much if not more assistance in their quest for power. As he says, the large-scale players cannot be seen separately from states and are best understood as different parts of a governing coalition. He finds great ways to explain it – for example:

“When international companies are trying to reach out into global supply chains and markets, they come up against a zone of slower conductivity in those pockets of informality where cash is used. Thus, in order to do business in Nairobi, Uber has to allow its Kenyan drivers to accept cash, but the Kenyan cash system jars with Uber’s planetary ambitions. If they could flick a switch to replace it with US-controlled Mastercard transfers, they would. They want to see payments crackling automatically from the streets of Nairobi, via the digital payments leviathans, to the streets of San Fransisco. And so the US state, for example, ends up pitted against the Kenyan informal market, via USAID”.

And of course, the Chinese state is doing exactly the same thing.

I’ll be blogging much more about this governing state-corporate coalition over the coming months, with more concrete examples (and fewer references to dragons) – and how we can build a commons-based economy: a ‘zone of slower conductivity’ of corporate ambitions.

What I learnt

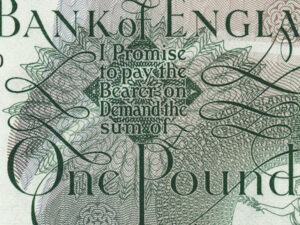

- The importance of cash on the extremities of the global economy – in the pockets, wallets and purses of ordinary people everywhere, and how it’s a spanner in the works of technocratic global capitalism. I used to think Brett was fighting a losing battle with his obsession with cash – but now I don’t. I’d urge you to ignore the champions of the cashless society, who are portraying cash as backward and unhelpful – including the nonsensical claim that it spreads Covid. It might be unhelpful to ambitions of corporate ‘progress’, in which case I’d say it’s highly beneficial. I always use it in our local pub, because the gaffer prefers it, as do the stallholders at our farmers’ market, and many of the small local shops. But the money cloud hates this, and does its best to prevent it, so entrenching corporate power, enabling surveillance of all of our transactions, harvesting of data for targeted advertising, and gaining the ability to prevent us from buying anything if it doesn’t like us, for whatever reason, including, in China, saying or writing something less than complimentary about the state. I can only do my bit – which includes paying in cash wherever I can, avoiding card-only establishments, and helping very clever people build trading systems that don’t require money at all, cash or otherwise.

- The use of cash is actually increasing, globally – mainly because in the midst of crisis, people don’t trust banks with their money one little bit. They want something they can hold in their hand and put in a box under the bed. This is true of any crisis – note that there’s an upsurge in withdrawals from ATMs in areas where there’s been a hurricane warning.

- Many central bankers around the world see it as part of their responsibility to protect cash, to support the poorest in society, and community-based businesses.

- Corrupt politicians, criminals and corporate tax avoiders do not stash ‘cash’ in offshore accounts – it’s all done using the digital money of the banking sector.

- Well, not exactly ‘learnt’ but realised the significance of – in a cashless world, what do you do if your bank starts to fail? How do you get your money out / how can there be a bank ‘run’ if there are no ATMs or even bank branches?

- Again, realised rather than learnt – we can have cloud money and cash, in the same way that we have cars and bicycles, digital music and live music, movies and the theatre, computer games and board games, zoom meetings and face-to-face meetings, online social networks and real friends, virtual reality and, well, reality. The new can supplement the old, rather than replace it – thank goodness!

“Adverts for digital payments don’t say: ‘enjoy the speed, convenience, surveillance, cyber-hacking and critical infrastructure weaknesses that our platform brings’”

Utopia?

Towards the end of the book, he shows us a potential antidote to the Big Finance / Big Tech stranglehold and the inevitable death of cash, from an unexpected source – central banks. However, cash can’t build a better system, it can just help to hold back a dystopian one. I favour a mutual credit world, without the need for either state-issued cash or bank-issued digital money (being no fan of either the state or of banks), but until then, sure – give me cash in preference to the banks’ debt-based cloud money.

We can resist and transcend the cloud money world, and corporate control generally – and we will, I’m sure of it. Banks are not indestructible, as they showed after the 2008 collapse, when they needed their state partners to rescue them.

Cloud money distances us from each other, in ways that are very bad for us. To that end, the more people who read this book, the better, I think. It’s essential reading, as usual from Brett Scott. His metaphors about how the monetary system works, and connects to everything else and his aerial overviews of the global economy are superb, and really bring it all to (horrific) life. It’s a scary book, illustrating the claustrophobic ways that almost everything we do feeds the corporate beast that is observing and analysing us. Read it, talk about it, give it to someone else. Let’s get this man more influence.

In the final chapter – yay! – he comes out in favour of mutual credit. He praises the blockchain community for building infrastructure that spans the globe, but is controlled by nobody. But is this really ‘decentralisation’? He points out that there’s another kind of decentralisation – based in communities and built around small, local businesses, permaculture-type food production, credit unions, co-ops and community-based exchange media too. Successful examples can be replicated in other communities and federated for scale, having no central focus at all. He notes that mutual credit is a more formal representation of the promises that groups of friends or family members give to each other, and keep, with nothing but informal ‘tallies’ in people’s heads. What he finds most interesting is the hybridisation of mutual credit with blockchain (as used by Grassroots Economics in Africa, for example), and by similar ideas, such as ‘rippling’ friend-to-friend credit. He sees this hybridisation zone as the ‘place to be’.

To that end, I’d like to suggest we host and publish a Zoom meeting to discuss the pros and cons (and opportunities for collaboration) within this zone – a group of 5-6 people (a small group without the cacophony of questions and comments that you get at conferences etc.), representing pure crypto, pure mutual credit, the Credit Commons, Grassroots Economics, ‘rippling’ credit and ‘use-credit obligations’. How about it Brett? Shall we drill into this? Shall we convene this group, ask the questions we want answers to, and make sure it stays super-respectful and super-accessible?

The views expressed in our blog are those of the author and not necessarily lowimpact.org's

The Future of Money (Part 1): with Brett Scott

The Future of Money (Part 1): with Brett Scott

The Future of Money (Part 2): with Brett Scott

The Future of Money (Part 2): with Brett Scott

A brief history of money

A brief history of money

Is it time to rethink the UN’s Sustainable Development Goals?

Is it time to rethink the UN’s Sustainable Development Goals?

Stroud Commons part 3: ‘Money Talks’ public event with Brett Scott, May 19

Stroud Commons part 3: ‘Money Talks’ public event with Brett Scott, May 19

Blockchain

Blockchain

Community

Community

Cryptocurrencies

Cryptocurrencies

Local / independent currencies

Local / independent currencies

Low-impact money

Low-impact money

Mutual credit

Mutual credit

Commons economy

Commons economy

Small is beautiful

Small is beautiful

Steady-state economics

Steady-state economics