Working alongside our partners at The Open Co-op, the Open Credit Network, a UK mutual credit network, is starting to win support from organisations like Goodmoney and Finance Lab. Matthew Slater shares how you can get involved.

I’ve learned in the last decade just how hard it is to work outside the money system. It’s like trying to work outside of Facebook – there just isn’t anything else equivalent, and all your connections are there. If you drop out of the money system you lose all your trading partners and may struggle to build a new network in a field which is narrower and has less powerful tools.

So if we want to make an alternative to bank-debt money, we need to be working at scale. There is almost no point replacing one money for another if every local pound is to be converted back to cash at the end. Alternative currencies only displace fiat currencies meaningfully when they literally go around and around the economy, and that means, in a complex, developed economy, that it must have a lot of traders. We saw how the Brixton Pound failed on the high street and became an art project. The Bristol Pound went further down the supply chain but not far enough. So how do we achieve the needed scale?

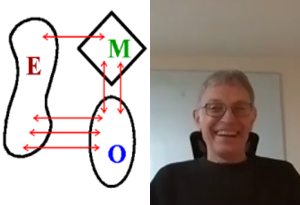

One obvious answer which hasn’t been tried yet is to cover a larger area. Trapping pounds in the local economy is only beneficial if they are circulating. So now the Open Credit Network is creating a UK-wide trading network, with the intention of diverting more trade towards wholesome producers, and displacing pounds with mutually-issued and mutually guaranteed credit.

The business model is pretty standard – they will form as a member coop inviting their traders to be members; costs will be covered by combination of network and transaction fees similarly to commercial networks like Bartercard, although unlike Bartercard, they will commit to accepting their own currency as far as possible from members. The unique selling point will be the focus on small, cooperative and ethical businesses. Trade is for mutual benefit, and if you have values, you should seek to trade with people who have similar values.

The few thousand business barter networks in the world tend to promise their members increased turnover, especially of unused capacity like empty seats in a restaurant or stock which isn’t moving, and yes it is about that. But this initiative is also about creating a new economy, new money and new payment rails alongside the old. So it’s not just about ‘turnover’ but about building relationships and trust which can be monetised, and committing to trade with one another where possible, to keep that money circulating amongst ourselves. It is a different way of thinking:

- Understand that the pound is your ticket to a global marketplace, and avoiding the pound means trade will be less convenient and efficient. But this friction isn’t just wasted energy, it means that every item comes with more of a story and more of a relationship. It makes you feel very differently about your stuff and your economic relationships.

- If the marketplace is small then you support it by modifying what you want. In capitalism we are encouraged to want very specific things, but a more sustainable approach is to want what is offered. And if something is not available, then bring a producer into the network or persuade someone in the network to produce it.

- When you shop in a supermarket a part of the money ends up locked away in a tax haven, but every pound you spend into a mutual credit network stays available in the network for you to earn back.

- In mutual credit networks every member needs to earn as much as they spend. Therefore you should not sell more than you can buy from the network or buy more than you can sell to the network.

The Open Credit Network has several alt-economy veterans (including me) on board, and is beginning to gain support from other organisations like Finance Lab. To become a proper business they will need start-up capital to cover the cost of software at the very least (don’t expect a cryptocoin offering though!). Right now they are looking for expressions of interest from small businesses, ethical business, and cooperatives. If that’s you, then click the ‘express interest’ button on their home page.

Matthew Slater develops software for complementary currencies. He co-founded Community Forge, which free hosts software for collaborative credit schemes; he co-authored the Money & Society MOOC, a free masters level multidisciplinary online course. He co-drafted the Credit Commons white paper, a proposal for a global solidarity economy money system, based on mutual credit principles.

5 Comments

Dealing with money ethically is stuff of a lot of writing. While amongst Muslims it is quite common to share financial resources largely based on trust the so called developed world has struggled to work out an approach that suits the needs of local economies and entrepreneurs. This new initiative is be worth knowing about.

The businesses we run now are an estate agency, a private dental and facial care surgery and management of rental properties (outsourced to the estate agency). It will be interesting to see how different kind of businesses can partake in this Mutual Credit Network.

Hi Ibrahim. Do register your interest, and we’ll keep you informed.

Great article, and absolutely, this is a fantastic project. Worth mentioning though that a variety of alternative disruptive approaches are needed. The Bristol Pound, agreed, hasn’t succeeded in achieving it’s whole vision yet, but it is on the way. And the concept is a different one to that of the UK Mutual Credit Network – the Bristol Pound is about bringing businesses and the community together in an effort to localise the economy of Bristol, to make it more resilient and inclusive. There’s room for both approaches – and more – as we try to make the world a better place by changing the way money works.

Hi Diana – agreed. Any and all alternative approaches, including local currencies and crypto, show that there are different ways of doing things. The benefit of crypto is that it takes control of the money supply from banks, but the problem is that it concentrates just as much as official currency, and that it uses enormous amounts of electricity. The benefit of local currencies is that, as you say, it keeps money in the local economy longer; the problem is that it requires debt-based, bank-issued money to buy it in the first place. We’ve gone for mutual credit because it doesn’t use tons of energy, doesn’t concentrate, and is completely separate from bank money.

Corrections: I was reminded that not all cryptos use lots of electricity – only proof of work currencies (although bitcoin is a massive part of the crypto world, and it does).

– and that not all local currencies require official currency to purchase in the first place (although I think most in the UK do / did).