Here’s a story. Some of you may know it, but I’m guessing that most people don’t, which is surprising because it has enormous importance for the way we live today, and how our children might live in the future. It’s an overview, and so it necessarily lacks detail, but it’s true in essence. If there are economists or historians out there who disagree, please let me know where I’ve gone wrong – in essence, not in detail.

Stage One

In the late Middle Ages, wealthy people deposit their gold, silver and jewels with goldsmiths, who put them in their strongholds – fortresses with thick stone walls and armed guards. In exchange, they give signed, sealed notes with the words ‘I promise to pay the bearer……’, and paper money is born. The goldsmiths get payment for storing the booty and depositors don’t have to carry gold and jewellery around, and risk having them stolen by highwaymen and bandits (the bandits have no use for the goldsmiths’ notes).

Stage Two

The goldsmiths notice that people very rarely withdraw their gold and jewels. Why would they? They have the paper notes instead, and their valuables are safe. So they start to hand out paper notes as loans, at interest. Soon there is many, many times more money on loan than exists in vaults anywhere and the goldsmiths start to become extraordinarily wealthy banking dynasties, like the Medici family in Florence. People recognise that their money is still safe in the goldsmiths’ vaults, but that the goldsmiths are making money from their money. They demand a cut, and instead of depositors having to pay the goldsmiths, the goldsmiths start to pay depositors for ‘use’ of their money to make money. Banking is born.

Stage Three

The monarchs of Europe begin to worry about the wealth of the bankers, and of the stability of the new economy. Banks run the risk of collapse if too many people try to withdraw their money at the same time; worse, the European economy is now dependent on bank loans; and even worse (for them), royal power might be threatened by the runaway wealth of the bankers. states start to regulate the banks, and in the 17th century, central banks are established to hold their bullion reserves, and restrict the amount of money they can lend out via the ‘fractional reserve‘ system – because banks only actually possess a fraction of the money they lend out.

Stage Four

By the 20th century, the fractional reserve system is the standard form of banking worldwide. The reserve requirement differs between countries, but an average is around 10%. If the rate in your country is 10%, or 10:1, and if you then found a bank by depositing a $10,000 reserve at the central bank, you can then loan out ten times that amount to your first customer. That first customer can then take his or her $100,000 to buy something, and the seller can then deposit that $100,000 in their bank. The seller’s bank then considers this ‘real’ money (although it was originally a loan) and they can keep $9,091 of it in reserve and lend out $90,910 (i.e. ten times the amount kept in reserve). This new loan gets deposited in another bank, and the process continues until, eventually, over $1 million is created from your original reserve deposit of $10,000. So if you take out a loan, including a mortgage, the bank will bring the money into existence by typing numbers into a computer, then you owe them that money plus interest. Genius.

Stage Five

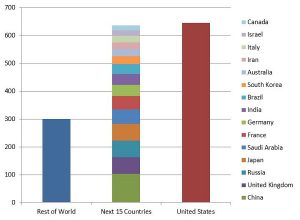

The fractional reserve system concentrates wealth and power at the top of the coporate and financial sector, and prevents the economy from stabilising (resuling in ecological damage). But the money men aren’t satisfied – they develop a bewildering array of credit default swaps, hedge funds, currency speculation, derivatives and other forms of gambling until by the 1980s the heart of the global economy had become, in effect, a giant casino. But it still isn’t enough for them, and by the 1980s their political donations and lobbying activity is so huge that they’re able to persuade governments to remove most of the remaining regulations limiting their money-making activities.

Stage Six

There’s an explosion in the financial sector. Foreign exchange transactions alone total over 20 times the amount generated by the ‘real’ economy – i.e. trade in commodities and services. Offshore financial havens and the issuing of credit cards by chain stores make a mockery of any kind of financial control, and funding of politicians and parties by the financial and corporate sector makes a mockery of democracy, but ensures that in good times, banks will make enormous profits and in bad times, taxpayers will bail them out.

Stage Seven

You decide. Ancient Rome was an empire run by slaves for the benefit of a tiny minority, and nowadays the corporate / financial empire is the same. The vast majority of the world live in poor countries and either work in or service corporate factories or plantations. They are, in effect, slaves, paid just enough to survive, with no escape. In the West we are mortgage and wage slaves too, but with fast food, sport, shopping and celebrity gossip to distract us from the reality of the situation. But Rome fell in the end, and the unsustainable nature of this empire will ensure that it will fall too. Do you want to continue to mortgage yourself to them, work for them, shop in their supermarkets, bank with them, get into debt with them to buy their consumer goods and follow their fashions? Or do you want to stand up and say ‘I’m Spartacus’?

—————————————————————————————–

NB: update – there is no longer a fractional reserve system in the UK. See here.