You may have seen a sensationalist video called ‘the End of Britain’ that’s been doing the rounds throughout 2013. It’s a flashy, authoritative-looking video, and well it should be, as it’s produced by MoneyWeek Magazine, part of the Agora Group – a large US holding company. The link is here, or here if you prefer text, but I warn you – you’ll feel your IQ dropping as you watch/read – I’d recommend giving it a miss and just reading this blog and the other two mentioned below.

They stress that their figures are correct, and I’m not contesting that. What I’m saying is that their interpretation of the figures is wrong, but more than that – deliberately wrong, in an attempt to divert even more money from ordinary people to corporate people – their people.

Here are their main premises, followed by why we think it’s just a corporate scam:

1. MoneyWeek: the UK economy is doomed because of too much spending on the welfare state.

Lowimpact.org: it’s a neoliberal magazine, by and for the corporate sector. The only problem they want us to see is the growth of the welfare state, not the billions that taxpayers had to find to bail out the banks after the sub-prime mortgage fiasco, or the invasion of countries who refused to accept the Western petrodollar protection racket, or corporate tax avoidance, or the gambling, corruption, ruthlessness and hunger for power that lies at the heart of capitalism.

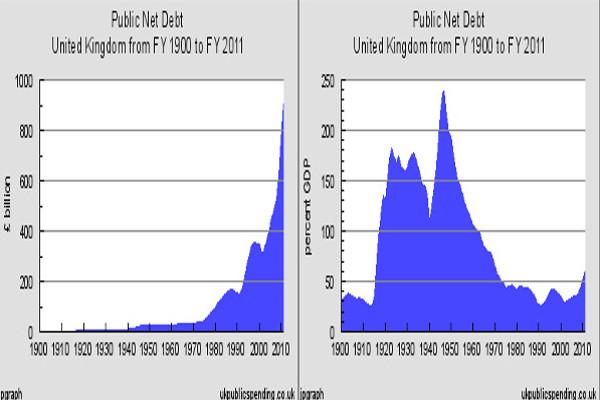

2. MoneyWeek: UK public debt is spiralling out of control, and if interest rates rise again, it will bankrupt us.

Lowimpact.org: this part is completely dishonest. Their graphs don’t take inflation into account, and therefore the difference in value between a billion pounds now and a billion pounds in 1940. This flattens out their debt graph considerably. Also, they don’t take GDP into consideration. When you do, the graph doesn’t look so scary any more. See the two graphs at the top of the page to see what I mean. More on this here. I don’t know him, but he’s spot on. He also points out that to make debt in relation to GDP in the UK comparable with Weimar Germany (as they do) requires some serious manipulation of the figures – like leaving out future pension liabilities in one, but adding them to the other. All extremely dodgy stuff, and thanks to the Yorkshire blogger for pointing it out.

3. MoneyWeek: we have to cut public spending back to the bone. Cameron and Osborne are wimps for only cutting the tiny amounts that they have.

Lowimpact.org: so the only solution they want us to consider is more extreme capitalism – austerity, no unions, privatisation, deregulation of the financial sector, bashing the poor by dismantling the welfare state and NHS etc.

4. MoneyWeek: there is no alternative (TINA) – there’s absolutely nothing else that we can do.

Lowimpact.org: the Icelandic people chose a different route. Instead of bailing out their bankers they went after them to recover their money and to put them in jail. Iceland is doing fine thank you very much, and the corporate media really, really, really don’t want you to think about that.

5. MoneyWeek: Argentina is an example of what not to do – towards the end of the 20th century they allowed their public spending to spin out of control, which caused their economy to collapse – and they still haven’t recovered.

Lowimpact.org: Argentina’s problems weren’t caused by government spending, but by following IMF recommendations in the 90s – deregulation, privatisation, tax breaks for the rich – you know the story. (This is another lie in the video, as well as the one about Argentina ‘still not recovering’. I know I’m not a fan of the quest for perpetual growth, but Argentina’s growth has been very respectable so far this century).

6. MoneyWeek: their predictions are always right, and they have lots of ideas for you, to prevent the coming collapse from taking your money.

Lowimpact.org: their approach is sensationalist because MoneyWeek‘s marketing team produced it to try to get people to buy their magazine. Here is a debunk of MoneyWeek‘s claim that they have consistently predicted the big economic events. Plus more on the inaccuracies in the video/article. Once again, thank you – another great blog.

MoneyWeek and their ilk want perpetual growth, the continuation of the fractional reserve banking scam and the global capitalist casino, the privatisation of profits and the socialisation of losses. It’s a corporate rag, with a classic neoliberal message: ‘big government bad’ (which I don’t have a problem with), ‘big business good’ (which I do). They want all profits to go to banks and corporations, and all bills to go to you.

At one point in the video, the commentator mentions that when governments impose high taxes on the rich, international investors punish them by removing their money from that country. For MoneyWeek, this means that governments should never do anything as stupid as upsetting international investors. For me, it highlights a point I’ve been making in blog articles for a while now – economic power trumps political power, from which it follows that we DO NOT have democracy. An elected government introduces a policy, and an anonymous, unelected band of investors forces them to change it. Russell Brand is absolutely right – why should we bother to vote for governments, when that’s not really where power is?

At another point, we’re patronisingly and moronically told: ‘you probably haven’t read this in the Telegraph or seen it on Sky News‘. That’s the demographic they’re aiming for. And with people who prefer to get their news and comment from Murdoch and the Barclay Brothers, they might well be successful.

But if you’ve read this far, I’m guessing that they’re not going to fool you. As for its advertising value – bearing in mind the inaccuracies, manipulation of figures and downright lies in the video, would you really trust the advice and dodgy deals offered by this magazine? If they were at all interested in talking about a different economic path, rather than moving faster down the suicidally damaging one were on at the moment, it might contain a grain of something useful. But there’s not one grain. Don’t buy it.