If you’ve got a sneaking suspicion that whatever we do, we’re not going to transition to a sustainable, democratic future with the current money and banking system, then I agree with you.

First, after initial feedback, let me explain something. I’m not suggesting that you take the course. You’d be welcome too, but I know you’re all busy. I’m going to be taking the course, and I’ll summarise outcomes here on this blog. If you have any feedback or questions for the course tutors (see below), let me know. I want to know if you think they’re on to something. I really think they might be.

Summary: they’ve worked out an implementable way to transition to a moneyless economy. Global account – everyone works for credit, purchases with debit. No rich or poor, no interest, no economic migration, stable economy is possible. Invented in 1836. Implementable now in the age of the internet with blockchain technology. Would make the entire banking industry redundant.

Would you like to come on a journey with me to learn more about how this money system evolved and how to replace it with something better?

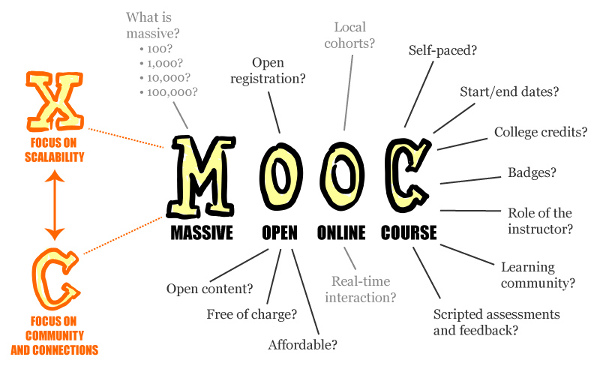

I’m going to be doing a free (as in gratis) online course, provided by the Institute for Leadership and Sustainability. Starting in August, the course is about the evolution of the money and banking system, the problems it causes and alternatives that could replace it. Actually, it’s a MOOC – see this video:

The course itself is free, but there’s a fee for a certificate if you pass (which I personally don’t need). As the Wikipedia entry states, there’s unlimited participation on a MOOC, so you’re very welcome to join me, but if you don’t have the time or the inclination, I’ll be summarising here, and you can comment or ask questions.

Here’s the course, and here’s a video with more info:

Two of the tutors involved in the course are Matthew Slater and Jem Bendell. The MOOC itself is just educational, and doesn’t propose one solution. However, I’ve come across their writing before, and I their position is that the banking system is unreformably flawed, for reasons I tried to summarise in a recent Facebook post:

I work for an environmental organisation, but I’m often disappointed with the position of environmentalists who think we can achieve a sustainable world whilst retaining the current banking system. We have to get rid of the corrupt banking cartel – the most powerful cartel the world has ever known. They:

-

have government-mandated monopolies on the issue of currency, via loans of money they don’t have, with compound interest attached, with security provided by the borrower. It’s a giant scam. Fractional reserve banking is ancient history.

-

charge so much interest (on loans of money they never had) that there isn’t enough money in the world to pay it all back. The economy has to constantly grow for the interest to be payable. This is the root of the ecological damage that puts human survival at risk – just for bankers’ profits.

-

make inequality worse. Although individuals can escape debt to banks, collectively, the world can’t (because there isn’t enough money to do so) – 2% of the world owns 50% of global wealth, and it is becoming more concentrated because of debt.

-

debase the currency by backing government deficit spending with their make-believe money, creating inflation which increases prices for ordinary people, increasing inequality even further.

-

choose who they give loans to – and it’s not to people who have useful ideas, if they’re not going to result in large profits for banks. So property speculation rather than socially-useful projects.

-

don’t just influence government – they are government. Trump has filled his cabinet with Goldman Sachs people. If you research the numbers of just Goldman Sachs people, let alone other banks, who sit in governments and in global financial institutions, it would take all day. Plus they give jobs to politicians when they leave office.

-

pay themselves huge salaries and bonuses

-

get bailed out with taxpayers money when they fail because they were just that bit too greedy.

Their solution is a moneyless, international, mutual credit system. Here’s a summary:

If the idea were to be implemented globally, there would be a free market – do what you like – there’s no state, tax, or planning. Nothing to scare off the right there (and if you scare the right, you set half the world against you from the off) – but there’s no money either. Everyone gets an account, set at zero. If you do useful work – either yourself or as part of a group, you get credit. When you purchase products or services, you get debit, and the person or group you purchase from gets credit. Every transaction carries a tiny insurance premium for when people can’t work. It’s like social security but it’s handled by a co-operative insurance company rather than a state. There’s a limit on how far you can go into credit or debit, so everyone’s account hovers around zero, and the sum total of all accounts is zero. It doesn’t matter where you are in the world – it works. You ‘plug into’ the system via a local trading bloc where you are known and trusted.

After a lifetime of reading political philosophy, this is the first idea that is, in my opinion, genuinely implementable. I can see it happening if enough people can be persuaded to get behind it. So far, Slater and Bendell have started to co-ordinate mutual credit schemes around the world (for example, time banks and LETS schemes) so that they can trade with each other. Slater is co-founder of Community Forge and they’ve started to build a partnership with an older organisation, the Community Exchange Systems Network. They are proposing a commons software architecture for a non-money system, and are looking for ways and partners to get it built.

Imagine if co-operative institutions can be co-ordinated to switch to this idea, purchasing things and paying wages via credit in a global mutual exchange system, it could really start to change things. Imagine getting your wages in credit, and then using that credit to get your food from community-supported agriculture, wholefood co-ops etc, your energy from community energy schemes, your telephony from the Phone Co-op and even your housing via a housing co-op. You can envisage a path to its implementation – something that’s lacking from most political ideas.

So I suppose I’m trying to persuade you to at least give it a look.

I think they’re right, and the more you think about it, the more problems it solves.

- It’s neither left nor right – it’s a free market, so it doesn’t have the bureaucracy of socialism, but it doesn’t have the exploitation of capitalism either.

- No money means no poor or rich people. You can’t accumulate money and it can’t be scarce because there isn’t any – just people doing useful things for each other for credit.

- No money means no interest, so the economy doesn’t have to perpetually grow to pay it back – which means that we can live in harmony with nature, which is impossible under capitalism.

- The fact that it works everywhere means no economic migration. You don’t have to move anywhere to get work – just work wherever you are. Families don’t have to be broken up for money.

- With no state, no tax system, no economic migration, there wouldn’t have to be nations, borders or armies – so a chance for peace.

- It’s a free market, but relations between people have to be free as well. There’s no making money from anyone else’s work – only your own. There’s no private employment – no ‘bosses’, and no landlords. You can own your own home or land (that you work) but no-one else’s. No shareholders, no return on investments, only work. The market is free for you to do whatever you like and see if people will pay for it – as a sole trader, or you can get together with other people in co-operative, democratic institutions.

- Credit can be allocated for work that is wanted – by individuals, co-ops or communities. Who gets credit is not decided by banks and it carries no interest.

[NB: these benefits are entirely hypothetical, and based on the potential of the idea. Whether these benefits materialise in reality depends on whether the idea can gain traction to reach a large enough scale.]

Let me know (below) your initial response, and ask questions. We can put those questions to them and generate ideas to make implementation more feasible. Let’s think of what’s wrong with this idea, and what questions we need answered. It doesn’t mean that we have to abandon what we’re doing – let’s carry on, but keep an eye on this as well. Otherwise all our work will remain marginal.

Positive Money explain the money system well:

But their solution is a state solution. I’m not convinced that switching fiat money issue from the banks is ultimately the solution, although I’d say it’s a step in the right direction. I’d prefer to get the economy into the hands of ordinary people, without being controlled by the state or the corporate sector. Also, I might be wrong about this, but I’m not sure that PM are challenging the (absurd and impossible) concept of perpetual economic growth. As long as there is money, it will concentrate, and there will be interest, rendering the economy undemocratic and unsustainable.

[NB: I was wrong – apologies to PM. This is from Fran Boait, executive director of PM: “As the catastrophic effects of a growth-led economy on the environment become more and more clear, the reality is that a finite planet cannot sustain infinite economic growth. In order to move beyond this dependence on growth, there needs to be a discussion of the systemic reforms which could support the transition to a fairer and more sustainable economy” – DD, Jan 2018.]

I think that Bendell and Slater’s idea is a winner, but I have some questions for them (and more reading to do in the mean time).

I’d like to ask them whether they can envisage existing non-corporate institutions switching to their scheme – even if partially at first. Countries of the ‘South’ have nothing to lose. Why wouldn’t their people do it, rather than work in corporate sweatshops or plantations? And there are plenty in the ‘North’ who would have a go with a system that might remove the power of money.

Here’s a paper by Matthew Slater and Tim Jenkin on a mutual credit economy. They call it the ‘Credit Commons’.

Here’s a chapter of a book by Jem Bendell, critiquing the current money system. Plus one more video (and if you only watch one of these vids, watch this one) – here he is nailing it:

And here’s a blog article by me, failing to disguise my excitement at having discovered what they’re up to.

Do you want to join me on this learning curve? The amount of time you spend on it is up to you. I’ll be blogging about what I learn. You could just drop in from time to time to see if there’s been any progress, or you could join the course. What do you say? Could you also please let people in your (electronic or face-to-face) social networks know about this. Thanks.

20 Comments

Thanks for posting, this looks very interesting and will check it out 🙂 From what I understand about Positive Money, their approach is more ‘evolutionary’ (and less experimental) that something that proposes a full system change. More of a concrete proposal for a top level ‘next step’.

Yeah, I can get with the ‘next step’ approach – I’m just wondering if these guys have a more direct route.

These links might be of interest:

http://www.open.edu/openlearn/society-politics-law/sociology/the-history-money#

http://northeastpermaculture.org.uk/storytime/understanding-money

https://www.peakprosperity.com/crashcourse (from the US)

Dave, I’ll definitely read your blogs, but I don’t think I’ll be doing the MOOC. Lots of questions. How do you define ‘useful work’? Surely there has to be some form of tax to pay for collective projects (health care, transport infrastructure, etc)? How would it be implemented piecemeal, when it needs to be global? What happens when you are too old to work?

Hi Bunk,

I’ve edited the article. I’m not asking people to do the MOOC, unless they’re feeling keen. I’m going to do it, and summarise it in the blog, so if people subscribe to it, they’ll get updates (plus alerts to articles about growing, building, installing, fixing and making things).

Plus if people ask questions, I’ll put them to the tutors.

Some of your questions I think I can answer.

‘Useful work’ is work that someone will give you credit for. So if you grow a sack of spuds, cut someone’s hair, build them an extension, fix their car etc, they give you credits for it, which you spend on products and services you want. A free market (unlike the one we have now) decides what’s useful.

I’ll ask about the tax thing, but I think they envisage co-operatives providing things that states currently provide, and community committees drawn from networks of co-ops / local enterprises deciding what they need, and offering credits to co-ops that can do the work. Some state services won’t be required, such as social security, which covers your ‘too old to work’ question. As I understand it, each transaction would include a tiny insurance premium (to a co-operative insurance company) to provide credits to those unable to work due to accidents, illness or old age.

Plus they’re going global straight away – see the two sites linked to in the article. They’re co-ordinating existing local mutual credit schemes globally so that they can trade between each other.

I’ll ask more when I can, and blog more as I do more reading / ask relevant questions.

D

Fascinating stuff, thank you. It’s interesting that tally / exchange systems were mentioned as the precursor to money by the Open Uni. Most economics textbooks repeat the ‘money evolved to replace barter when it became too unwieldy’ myth. And Mary Mellor was one of the authors of ‘The Politics of Money’ – one of the books that switched me on to this stuff.

Thank you.

Well Done Dave, I am interested in doing this if I can convince myself that I can squeeze it into my life. I will talk with you about it next Friday 🙂

I’ve signed up to the couese. Thanks for bringing it to my attention. I wonder what safeguards would need to be in place to stop vested interests taking over this proposed global economy and to prevent it falling into plutocratic hands?

Great! So far around ten people have said they’re going to do the course. I’m going to summarise on the blog for people who don’t have time.

Your question – you say ‘plutocratic hands’, but a plutocrat is someone who rules because they have money. But there wouldn’t be any money. You’d only be able to get credits for useful work done, with limits on how far you can go into credit or debit.

Great stuff, looking forward to hearing your notes.

Two issues I’m interested in seeing tackled –

Why would those with massive amounts of wealth and therefore power allow such a transition?

And how do you overcome this very pervasive notion that just like a universal basic income, people feel that without economic incentive, many would choose not to work, or not work very hard. Would the collective take care of them regardless?

Just my interpretation – it would be difficult to stop it. It would decentralised / nodes with no centre that can be shut down. And it would almost definitely have better hackers.

There would be economic incentive. If you want a nice house, to eat good food, social status, the kind of entertainment you want, you have to work for it. If you don’t want those things, then don’t work. It’s up to you. There’s no collective care for those who won’t work, only those who can’t.

Plus, if gangster hackers take down capitalism, it’s not going to be pretty. But if they took down a bunch of websites hosting a ‘credit commons’, all it is really is a giant account hovering around zero. It doesn’t contain any value in itself – it’s just a means of exchange. it could be built again, quite easily. Even if the internet goes down, it could revert to clay tablets or tally sticks kept in the temple, together with local trust. Capitalism falling over would be catastrophic – it would all get pretty savage quite quickly. As long as we don’t allow our money system to be a store of value as well as an exchange vehicle, we’ll be ok. It can’t concentrate then. And this is the only idea that really goes to the root of it I think. But yes, I’ll be looking into it a lot more, and reading what other people think.

Dave, great article thanks. Some questions to ponder:

I wonder how the accounts would be protected from credit thieves and how a record of value would be stored and proved when one wants to “buy”. Also if we were all to start at zero, those with assets would still have a massive advantage, how would that be dealt with?

Good questions. I’ll ask. Here’s a shot at answering them:

Theft: what would you do with the credit you’ve stolen? You can’t accumulate it – there are limits. You can’t sell them, because what would people buy them with? Other credits? Wouldn’t really be any incentive to ‘steal’ credits. Thinking about it, it wouldn’t be possible, because the entire account balances at zero, so to ‘steal’ credits would mean putting others into debit, but how would they do that if there wasn’t a deal between two people. It would easy to see where the ‘stolen’ credits are, because there would be no corresponding debits for someone else. I don’t think conventional theft would be possible.

Recording and ‘proving’: blockchain. Don’t ask me to explain, but I know people who can.

Assets: what kind of assets? Money assets would be worthless. Say if someone has a large house. Going to need a lot of maintenance, and that can’t be paid for with money, only work. So it’s going to take an awful lot of work for the upkeep of a large house. Large houses will naturally get split into flats (which can’t be rented out – because there’s no money and a limit on credit, so they’ll be given away or squatted. The local arbitration committee will have no problem with homeless people squatting an unused building, and neither should they) or taken over by co-ops. People will only work for the housing they need. Same with land. If you can’t work it, it’s not valuable to you. Land will naturally split into smallholdings big enough for people to work. Say they have a large number of saleable assets. How are they going to sell them? There’s no money, and there’s a limit on credit. So they’d have to give the assets away, or have them sit around, cluttering the place up.

OK, there could be a scenario where someone gives away saleable assets for credits, uses the credits, then gets more credits via more assets, so they don’t have to work.

But – they do have to lose something to get credit, and at some point it will all be gone. I don’t suppose it’s fair for as long as it lasts, but it won’t last forever.

Also, to keep assets safe is going to take work, so people may well be using all their credits just keeping their assets secure. It may be better for them just to give their assets away, and work for more useful things. They’d certainly be respected more for that. And it just wouldn’t make much sense to hang on to assets that could lose value, be stolen, require looking after etc.

Thanks for sharing this Dave.

This makes sense but I am a little cynical (or can’t see it happening) about how it would transition largely based on a similar question to Sam Ryan’s (comment 10): ‘Why would those with massive amounts of wealth and therefore power allow such a transition?’

How does existing capital transition into such a system. The wealthy would never relinquish their power.

If everyone’s monetary value in ‘fake interest bolstered banks’ is scratched out the idea is that everyone is equal. However this doesn’t work for existing non-monetary capital such as land, machinery and other manufactured goods that have been purchased in the current system. Inequality remains as soon as this form of ownership remains. So it’s not just money, it’s ownership that has to change as land etc. has no value if it just becomes overgrown and useless to man (beyond providing ecosystem services). Landowners would be getting nothing from their ownership. So society would be called upon to work it in greater numbers, essentially to de-evolve away from machinery and gain trade-able credit for their labour.

Equally there are so many jobs that currently pay more, do senior positions ‘pay’ more in this ideal system to make up for years of education/experience? If so wouldn’t that just create the same inequality? Can man live in an equal world?

Hi Pascal,

It’s mainly about getting rid of the current banking system, which we have to do one way or another.

The key is that once people with no money (i.e. most of the world), get to understand the kind of lives they could have compared to their lives in capitalism, the potential is huge. More so when you add the people in the West who hate their capitalist jobs, or just hate capitalism, which is quite a lot of ‘low-hanging fruit’ who will give it a go. But once the supply of cheap labour is taken away from corporations, their competitive edge has gone, and they’re finished really. Their money starts to be worth less and less.

If you have a look at the bottom of this article, it answers this question – http://www.lowimpact.org/credit-commonsworld-without-money/. It’s a summary of the idea plus a stab at answering people’s questions. It also includes the question about whether people with assets will have any advantage and I argue that they won’t.

But you’ve nailed it in that without work, land has no value except to nature. All real value comes from work. If you trace it back, someone has worked for it. But as you can’t take credit for anyone else’s work, you won’t be able to farm large areas unless you form a co-op, or other people just squat the land and work it. And both those things are fine by me.

The pay of people in co-ops who take on more responsibility will be decided by the co-op, just as they are now, but generally, the credit paid for work is decided by the people in the transaction. There’s nobody setting prices. If you’re a doctor, the credit you get for your work will probably reflect your knowledge and your minimum of 7 years’ training.

And from the other article:

Q: How do you decide how much credit a piece of work is worth?

A: The two people or groups involved in the transaction decide, in a completely free market. If a plumber asks too much to fit a shower, you can find one who charges less. It will all balance out in the end, as people come to realise the true value of work.

Hi Dave,

I am interested in joining the course. How do i get on to it. Is it too late? I’ve also read your blog on it.

Thank you

Too late for this one – it’s halfway through now. Next one starts in Feb 2018. See http://iflas.blogspot.co.uk/2014/12/money-and-society-mooc.html

Facinating ideas. and facinating too that we have gone from tangable to intangable money as if there is no different?