Here’s a quick and dirty history of money, but keep in mind that we mustn’t think of ‘money’ in long-gone societies as being similar to ours. Their words for money may have meant very different things – maybe receipts or IOUs or even tax vouchers. In modern Europe, coins were introduced about 1000 years before banking, but in ancient Babylon, banking was introduced about 1000 years before coins. Both banking and coins disappeared and reappeared at various times and in different places. It’s impossible to generalise when it comes to the history of money.

Contents

c. 700 BCE – c. 600 CE: The Axial Age

600 CE – 15th Century: the Middle Ages

15th – 19th centuries: early capitalism

19th century – present: the last 200 years

Overview

Some of this history comes from David Graeber’s Debt: the First 5000 years, Glyn Davis’ A History of Money, Felix Martin’s Money, An Unauthorised Biography, all of which can be obtained here. They come highly recommended. Davis’s book can also be accessed as a pdf here. Some is from Matthew Slater and Jem Bendell’s Money & Society MOOC (also highly recommended – and free), as well as various other sources.

We have to understand that most people throughout history never used money, as in notes or coins. Most ordinary people got the things they needed through a system of credit of some sort – either recorded officially, or just held in people’s heads. In a medieval inn, for example, everyone could get beer without paying anything, because the innkeepers needed lots of things from their customers – eggs, meat, dairy, fish, vegetables, fruit, cereals, blacksmithing, masonry, thatching, carpentry, furniture, clothes, baskets etc. – all of which were supplied by local people who wanted beer, as well as the things that other people produced. They didn’t have to bring these things to the pub though – it wasn’t barter; it was a kind of mutual credit in people’s heads. Everyone knew who was pulling their weight and who wasn’t. Most people didn’t stray far from home. This kind of mental (or recorded) tallying happened in most places, in most ages.

But in some places, in some time periods, people used (or were required to use) coins. Why? Well, possibly due to war. It’s unwise to offer credit to passing soliders, and so in times of upheaval, war and empires, coins appeared. Rulers issued them to soldiers, who could buy anything they needed from the citizens, because the rulers decreed that citizens needed the coins to pay their taxes.

There seem to have been 4 great eras where either credit dominated (during times of relative peace and scattered kingdoms) or coinage / commodity money (corresponding to times of war and empire-building).

- Pre-Axial age (before about 700 BCE): mainly scattered kingdoms, pre-coinage, money was credit.

- Axial Age (c. 700 BCE – 600 CE) – an age of empire, conquest, war and coinage.

- Middle Ages (c. 600 CE – 15th century) – a relatively peaceful period, scattered kingdoms, money was mainly credit; coins were scarce.

- Modern Era: (15th century – present) – back to coinage / commodity money, conquest and war.

Perhaps we’re about to enter a new era of peace and credit money. Let’s hope so.

Origins of money

Let’s start with a theory that’s been discredited, but that can still be found in many economics textbooks. The story is that people were struggling to trade in a barter economy – they had to find someone who had what they wanted, and wanted what they had, which is difficult. They might have to cart sacks of potatoes around until they could find someone who wanted them. Someone came up with the idea of using something as a medium of exchange, like cattle, dried fish or salt – something that was useful in itself, so that you knew the value of it. This eventually changed to tokens that could be carried around more easily – like cowrie shells or precious metals. Then one day a wise king decided to mint coins, stamped with his head to ensure weight and purity, and give them to his grateful subjects as a medium of exchange that they could carry around easily, and that everyone would accept, so that trade could be facilitated in the realm. But this is not what happened. Throughout history, people have lived without money, in communities in which ‘everyone simply keeps track of who owes what to whom’ (Graeber). And again, this wasn’t barter, due to the difficulty in finding a direct reciprocal trade. In fact, there’s never been a society in which the main means of exchange was barter, and money didn’t evolve from barter, but from mutual exchange within communities – where the vast majority of exchanges took place. Barter was always marginal and between strangers, and in fact the root of the word can be found in ways to cheat, deceive or to have sex with (and there are many other words for that!). That this is a theory still usually taught to economics undergraduates is scandalous. There are some real-world ‘origin of money’ stories scattered through this history.

Pre-700 BCE

Lots of ‘origin of money’ stories are lost in pre-history, and lots of things were used as money – for dowries, for religious ceremonies, ornaments to display status, protection money, fines to families for killing one of their members etc. And the things used could be a whole range of different objects, depending on the culture. No-one is absolutely sure of the details of ancient monies.

Origin of money 1: ancient grain receipts

After the agricultural revolution and the development of the first cities, the ruling class didn’t develop by seizing the means of production, but by gaining a monopoly over the means of exchange and distribution. Farmers put their grain in collective granaries for safe storage, and got receipts for the amount of grain they’d delivered. As towns grew, so did the number of administrative, urban jobs, and a management class took over this central grain-based accounting system; and grain began to be lent in lean times. In the Sumerian empire, farmers deposited first grain, then other crops, tools and precious metals, in temples and palaces that had thick walls and guards to keep the deposits safe. They obtained receipts for their deposits on clay tablets, and these tablets could be used to collect their deposits if necessary, but they were also used to purchase things, clear debts and pay taxes. The earliest known examples of (cuneiform) writing were in fact accounts; and the earliest known bank was the House of Egibi in the city of Babylon, which operated in the first quarter of the first millennium BCE (Davis), although banking had existed since the third millennium BCE. They accepted deposits and provided loans and bank transfers, as well as foreign exchange (with the Assyrians, for example). Many banks existed in Sumer, and also in Egypt, where grain was the most important deposit. More here (great article).

The first Banks were popular because if you paid debts or taxes via the bank, you had an official record that couldn’t be denied.

The very earliest ‘coins’ appeared in China around 1200 BCE, although they weren’t coins as we know them. They were identically-cast tools like knives or adzes. China’s coins were always of base metal and therefore of low intrinsic value – unlike the high-value precious-metal coins that developed in the West. For this reason, banknotes appeared hundreds of years earlier in China, for high-value payments.

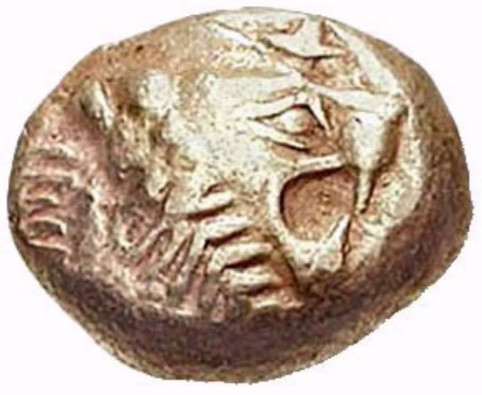

The first non-Chinese ‘pre-coins’ (ingots) appeared in Asia Minor before 2000 BCE. The ingots got smaller, got stamped, got rounder etc. until coins proper appeared in Lydia and Ionia (still in Asia Minor) in the 7th century BCE, during the reigns of two kings famous for their wealth – Midas (as in ‘Midas touch’) and Croesus (as in ‘rich as’ Croesus) – although both were possibly mythical.

c. 700 BCE – c. 600 CE: The Axial Age

Origin of money 2: tax tokens

Citizens of ancient empires and city-states paid taxes with grain or other produce, or labour; but at some point in Greek Asia Minor around the 8th century BCE, coins appeared, and by the time of Periclean Athens in the 5th century BCE, rulers were minting coins for their subjects to earn so that they could pay taxes with them. The coins were used to pay soldiers, who used them to obtain food, clothes, accommodation, booze, women and weaponry, and the public queued to give them those things, to get the coins they needed to pay their taxes. Previously, soldiers had to scour the areas around their camps to requisition food and provisions, but now local people willingly came to them. It was much easier – the ruler could also pay farmers, masons, blacksmiths and carpenters to provide food for the court, horses, castles, weapons and ships, and the soldiers were used to enforce payment of taxes. Once this system was in place, it was easier for rulers to accumulate wealth and build their empires. Where a particular ruler’s coins circulated outlined the limits of that ruler’s realm, and ‘legal tender’ appeared for the first time.

David Graeber on one origin of money – to pay taxes (from 15.20)

Dominant nations or cities (like Athens) extended their power by spreading the use of their coinage, and by doing so, they spread the money system too. And on it went. Money-military-slavery complexes (from Graeber) developed (Alexander’s empire, Rome, various Indian empires, China during the Warring States period), which worked like this:

- Conquest – slaves captured;

- Slaves put to work in silver mines;

- Coins made from the silver;

- Soldiers paid with the coins (as well as shipbuilders, weapon-makers etc.);

- Conquered people ordered to pay taxes in the coins;

- People provisioned soldiers for coins;

- Armies were fed well, and conquered more lands.

Alexander captured local mints, that were then used to mint more coins for him to continue his campaign, often from melted down treasures in those cities. Similar things happened during the European colonisation of the world in the 19th and early 20th centuries – see ‘hut taxes’, below.

Often, the value of coins wasn’t stamped on them – their value was announced by ordinances. In that way, the ruler could devalue the currency, pay people high-value coins, then devalue, so that people then need more of them to pay their taxes. It was the equivalent of an additional tax. This suited the sovereign, but not the subjects.

So it was via the goods and services that rulers were able to claim from people who needed their coins to pay taxes that allowed tyrants to build their empires (and to feed soldiers, who were also, ironically their hit men to ensure that the plebs paid their taxes)!

Whoever controlled the issue of money was able to organise society to transfer wealth from ordinary people who created the wealth, to themselves. (Does that sound familiar?)

Athens was the first fully-monetised state. Coinage spread rapidly around the Mediterranean, and through Mesopotamia and Persia to India.

In Sparta, coins were iron discs, made brittle by dipping in vinegar (so they weren’t even valuable as iron – they were only valuable because the state said they were). Spartan rulers deliberately avoided making the coins from precious metal, so that the coins had value just because the ruler said so, because he was the ruler. Gold and silver were only used for trade outside the boundaries of the kingdom – where their fiat didn’t work. Internal fiat money couldn’t be stolen in war, couldn’t leak out of the country for luxury goods from abroad, and as much could be produced as the ruler wanted. Also, if a state’s money was a useful commodity (precious metal) – the state would be on a constant quest for precious metal – a waste of energy and resources.

Rome vs the moneychangers

Rome’s money was stamped on thin copper (they didn’t have paper), but the value of the coins was much more than the copper itself. So the ascent of Rome was based on fiat money (money that’s only valuable because an authority says it is). Later, they conquered lands and stole gold and silver, which was used to produce coins (around 200 BCE). But this involved a lot of work to get, and could be stolen. It ended Rome’s financial independence.

Moneychangers became very powerful via usury (lending at interest). In the second and third centuries BCE, two emperors tried to restrict usury and were assassinated.

Julius Caesar brought control of the money system back to the state, in order to build large public works. He was assassinated too.

Jesus vs the moneychangers

Jews needed silver shekels to pay taxes. Moneychangers cornered the market and raised the price of money to what the market would bear. They did their transactions in the temple, which was considered profane. Jesus used violence for the only time during his ministry (whether the story is true or not is irrelevant – it has passed down to highlight the profanity of the banking industry) to throw the moneychangers out of the temple.

Jesus was killed too of course. There was a bit of a pattern developing, that would be repeated many times.

The christian church prohibited usury, but in the end, was defeated by the money-men. Jesus may have won the battle with the moneylenders in the temple, but the church lost the war.

600 CE – 15th Century: the Middle Ages

After the fall of the Roman Empire, coinage began to disappear. But throughout the Middle Ages, there were various developments that set the scene for the birth of capitalism and the monetisation of everything after the Renaissance.

Origin of money 3: bills of exchange

The Hawala system was born in India in the 8th century and was used to transfer payments between south and east Asia and the Middle East for goods that were moved along the Silk Road. It’s a system that continues to this day, and works like this. Hawala agents are trusted business people who may run shops or other local businesses. Someone wishing to transfer an amount of money to another country deposits the cash with their local Hawala agent, along with the town the remittance is to be sent to, the name of the person who will collect it, and a password. The password is sent to the receiver, who walks into their local Hawala office, gives the password and receives the cash. No bank account required. The agents charge a fee, and if the amounts they send and receive get too far out of kilter, then accounts can be settled with payments of some description between the agents – not necessarily money. It’s all based on trust, and works because the agents don’t want to damage their business reputations in their communities.

The Knights Templar had opened up trading and pilgrimage networks around Europe and into the Middle East (Charles Greenstreet Addison and Robert Macoy, The Knights Templar History, 1978), where they may well have learnt about the practice of Hawala. They developed extensive banking and financial services, so that European merchants could deposit coins, gold or valuables at one branch and withdraw them at another, in another country, by presenting a document that was in effect, a travellers’ cheque. This removed the risk for merchants of carrying valuables around the continent, and the cheques were of no use to bandits. The Knights Templar facilitated a boom in international trade, but after they were disbanded in 1312, merchants found it difficult to purchase goods abroad. Early banks stepped in by providing ‘bills of exchange’ – up-front payments for foreign goods. These bills were carried around Europe on horseback, and were accepted by sellers everywhere. When the merchants sold the goods, they repaid the banks, plus a fee, usually around 10%. They were careful not to call this a loan, as usury was illegal – it was just a money transfer for a specific purchase, with a fee attached, not interest. The bills of exchange started to be passed around as money, and the banks started issuing them for domestic transactions, not just foreign trade. There was no limit on the number of bills they could issue, and there was nothing to back them. After the Knights Templar were disbanded, they went underground to continue their activities – probably in Switzerland, which is (possibly) why it emerged as a banking centre.

Origin of money 4: ‘common tender’

We’ve mentioned the fact that most transactions for most common people throughout history was in the form of reciprocal favours – a type of mutual credit recorded in people’s heads. There were also local currencies that passed between traders on market days – people who knew each other but didn’t necessarily live in the same village. Local currencies could be issued as IOUs, by people who were know and trusted – and their produce was good. This included farmers, bakers, brewers and craftspeople. Coinage was used in the Middle Ages mostly by royalty and nobles, for luxury goods, and for waging wars. ‘Common tender’ that included mutual credit, IOUs and local currencies were used by ordinary people who may never have used coins. This meant that if there was an economic crash which meant that coinage was scarce, ordinary people didn’t suffer in the way they do now, because they’re reliant on official currency. Ordinary people could issue ‘money’ whenever they needed it.

Paul Grignon’s take on common tender – medieval market money.

Bracteates – exchange but no store of value

In the early Middle Ages in the Holy Roman Empire, thin metal tokens called bracteates were made and distributed locally by princes and monasteries to serve as media of exchange. They had no intrinsic value, and were recalled regularly, often annually, with a small deduction – enough to dissuade people from holding on to them, and persuade them to spend them into the local economy instead.

Bills of exchange become transferable

Italian banking families (like the Bardi and Peruzzi – in Lombardy, hence Lombard Street in the City of London) in the 13th and 14th century became very rich. But how, without usury? It was via bills of exchange (which were a bit like cheques). Merchants could deposit money in an Italian branch of a bank, then take a bill of exchange with them to pay for goods abroad. It would be no good to thieves, as it was payable to only the holder, like a cheque. The banks would charge a 10% fee for this – no usury. Or – merchants could promise to pay a certain amount after a trade was done, and ‘borrow’ money – via a bill of exchange – to do it. When the trade was done, they would pay back the cost of the bill of exchange, plus an agreed fee (usually around 10%). The supplier was happy to take the bill of exchange because he knew he could cash it at the bank.

Lots of bills of exchange started to be written, that weren’t backed by anything, and so they were produced in huge quantities. Later, the law was changed to allow them to be transferable, and so they circulated through the economy as money, at least for bigger purchases. Bankers became incredibly wealthy – wealthier than royalty. They behaved a bit like Mafia families, with intrigue, corruption and assassinations. They didn’t actually need interest to become so wealthy, as long as they had money-issuing powers and monopolies.

The Medicis were one of these banking families, who became bankers to popes and royalty, took charge of Florence and sponsored some of the great architects and artists of the Renaissance, like Michelangelo and Leonardo da Vinci. They were merely promoting their ‘brand’.

Origin of money 5: goldsmiths’ receipts

In medieval Europe, goldsmiths built strongrooms to keep their gold safe. They would store other people’s valuables in their strongrooms too, for a fee. They began to issue receipts for valuables stored, that could be used as money, so that when nobles wanted to buy property, for example, they didn’t have to carry gold and jewellery around a country infested with bandits. They could use the receipts as a way to buy things, because the seller knew that the goldsmiths were storing goods to the value of the receipt, and that the receipt was a claim on those real goods.

The goldsmiths started to lend these receipts, and charge interest. They circulated as money, and the goldsmiths started to get richer. Then, when they realised that people very rarely collected their valuables, they could risk lending more money than was backed by treasure in their vaults. And they did – many times more, until their lending became much more profitable than their goldsmithing. They became the first modern bankers – the beating heart of a system that was required to generate the funds for the campaigns and the palaces of royal and aristocratic families all over Europe, and later, the enterprises of the capitalists who took over the economy.

These early bankers became wealthier than monarchs. In fact, Jakob Fugger, a German banker born in 1459, is considered (adjusting for inflation) to be the wealthiest person who ever lived (Greg Steinmetz, The Richest Man Who Ever Lived: The Life and Times of Jacob Fugger, 2016). The bankers’ trick of lending non-existent money had to be enshrined in law, because it came to represent the foundation of European economies. It was called fractional reserve banking – the banks only had to keep a fraction (usually around a tenth) of the amount they lent out, in reserve in their vaults.

15th – 19th centuries: early capitalism

John Calvin was credited (or blamed) for the relaxation of usury laws, but whoever was responsible, the ban on usury was certainly ended, resulting in a boom for bankers.

The birth of bonds

In italy, at the beginning of 15th century, bonds were introduced by the cities to fund wars. Purchasing state bonds became compulsory for citizens, but interest was paid on them. Bonds were promises to pay in the future. Because of fractional reserve banking, banks were able to buy up most bonds with money they didn’t have. So governments issued bonds to get the resources of the citizens to fight wars, but governments actually ended up deeply in debt to the banks.

Spain and Portugal lose out

Spain and Portugal had carved up the entire world between themselves in the 16th century, and galleons were importing gold and silver from Latin America every year. But a century later, they were among the poorest countries in Europe. They spent their American plunder on palaces and luxury goods, instead of developing banks and industries. They transferred money to merchants in other parts of Europe, where wealth and power began to concentrate.

This bullion from the new world formed the springboard for capitalism and the industrial revolution, but Spain and Portugal didn’t benefit.

The Great Settlement – foundation of the Bank of England

There was a constant tussle between banks and the state for control of the money supply. In Britain, Henry 8th relaxed usury laws and moneychangers prospered. Catholic Mary re-tightened usury laws, moneylenders hoarded coins and the economy shrank. Elizabeth took on the moneylenders, and issued gold and silver coins from the public treasury. Cromwell was funded by moneylenders, and provided licences for them to operate legally. They were given a square mile in the City of London to ply their trade.

This battle was ended with the founding of the Bank of England (the Great Monetary Settlement). It was the result of a deal between the sovereign and bankers – but only after the Glorious Revolution of 1688 had given real power to parliament. The sovereign (state) endorsed bankers’ private money, and allowed it to circulate throughout the country as legal tender (that you can pay tax with). In return, state finances were put on a sounder footing, and the state had money to fight wars.

In 1688, William and Mary came to the English throne. William was in a war with France, and needed money desperately. Moneylenders generally refused (they’d been stung by royalty when the Stuarts had reneged on debts). Scot William Paterson came up with a plan – a loan of 1.2m from a consortium (largely Huguenot merchants, whose names were never released) who, in exchange, would be allowed to form a central bank. This happened in 1694. It provided money as debt to the king, and by 1708 it had virtual monopoly on issue of banknotes.

This was the start of a central bank / state system that survives today – the government can sell bonds to the central bank – so that they can spend without putting up taxes, and banks can lend money that they don’t have and charge interest on it. Debt started to grow uncontrollably. All countries now have central banks based on the Bank of England model.

US presidents v the bankers

There were several attempts to form a central bank in the US, and various US presidents were violently opposed to it – because they favoured democratic government over an unelected ‘money aristocracy’.

Alexander Hamilton wanted to establish a central bank in America modelled on the Bank of England. Jefferson trusted Hamilton and didn’t understand banking. Later, Jefferson, Franklin and Madison opposed it – but it was a battle that raged until the Federal Reserve was eventually founded in 1913.

Andrew Jackson was the biggest opponent of central banking, and famously said ‘I killed the bank’. Bankers tried to crash the economy by restricting loans and blaming Jackson. But Jackson made alliances and the bank idea stayed dead. He survived a failed assassination attempt.

Lincoln applied for loans from bankers, who wanted to charge extremely high interest rates. He refused, and instead, got congress to authorise the printing of money by the government to fund the civil war. The notes were called ‘greenbacks’ because of the green ink on the back. These were printed without interest to the govt (i.e. to taxpayers), to pay for troops’ wages and supplies. Lincoln was of course assassinated.

Hut taxes

When Europeans colonised Africa, they found it difficult to get Africans to work in their plantations if they already had small farms. Their solution was to introduce money into the African economy. ‘Hut taxes’ became payable – i.e. if you had a hut (which everyone did), then you had to pay a tax to the colonial authority. The taxes had to be paid in coins produced by the colonisers. When Africans asked how they were supposed to get these coins, they were told that they would have to work for them, in colonial plantations. If coins weren’t available locally, taxes could also be paid directly with work (Narissa Ramdhani, Financing Colonial Rule: The Hut Tax System, 1985).

In this way, money was introduced into parts of the world where it had never existed before. Whoever had the strongest army could issue money to organise a society to transfer wealth from ordinary people who created it, to themselves. It was a means of control, that hasn’t changed.

19th century – present: the last 200 years

This section is just to show that ‘money’ is not some given monolith that exists independently of world events – it’s constantly changing. 1971 was possibly as significant as 1694. Another momentous change is due, but it’s important that it’s the right one. Here are some of the big changes over the last 200 years.

In 1821, the UK introduced the first official ‘gold standard’, and other developed countries followed. It meant that all bank notes could be exchanged at a bank for gold. In other words, currencies are ‘backed’ by gold. This gave confidence in national currencies, but was discontinued when World War I saw combatant governments printing money like crazy to fund the war effort. The Federal Reserve (the US central bank, founded in 1913) was allowed to put $100 into circulation, backed by only $40 worth of gold, and between WWI and WWII, notes were only partially redeemable for gold. This was called a gold exchange standard, a type of fractional reserve banking that required banks to hold only a fraction of the value of the money they issued in reserve as gold.

1920s and 30s

During the ‘Roaring Twenties’ – the Federal Reserve increased the money supply. Interest rates were low, and companies and individuals got into a large amount of debt.

The Great Depression: on ‘Black Thursday’ in August 1929, banks stopped lending and called in loans. People had to sell their stocks for any price to service their debts, but the big names (Morgan, Rockerfeller et al.) had taken their money out of the stock market and put it into cash or gold.

Wikipedia states that the Keynesians believed that the Great Depression was caused by people hoarding money, and refusing to consume or to invest, and that monetarists believe that it was caused by a contraction of the money supply. Both had an impact.

Wikipedia also says: ‘There is consensus that the Federal Reserve System should have cut short the process of monetary deflation and banking collapse.’, and ‘By not lowering interest rates, by not increasing the monetary base and by not injecting liquidity into the banking system to prevent it from crumbling the Federal Reserve passively watched the transforming of a normal recession into the Great Depression.’ This sounds as if the banks are passive, and don’t understand the consequences of their actions – as if the ‘boom and bust’ business cycle doesn’t exist. If banks can make lending easy then tighten it up and foreclose on lots of businesses and homes, sell them, make more money and repeat – why wouldn’t they do it? Banks are able to make money scarce. The business cycle doesn’t just happen.

1940s, 50s and 60s

During WW2, European economies were turned over to war production, and farm and factory workers were sent to war. Consumer goods were bought from the US, mainly with gold. The US entered late, and by the end of the war, had two-thirds of the world’s gold. Europe had virtually no gold, but was later flooded with dollars lent by the US. The global economy couldn’t continue in the way it had, and so representatives of world governments met in Bretton Woods in the US in 1944 to devise a new system. From that meeting came the World Bank and the International Monetary Fund. All global currencies were backed by the dollar, which was backed by gold, at $35 per ounce. This brought stability, with all currencies pegged to the dollar, rather than floating around freely. World trade boomed. But no reserve ratio was established, so this was, in effect, zero reserve banking, or at least the freedom for banks to do that. Banks could create money freely and states could spend it freely.

In 1949, Diners Club cards – the first credit cards – were introduced, and since then, credit card debt has boomed (provided by all kinds of corporations, not just banks) to the point where it makes a mockery of any government or collective attempt to control the money supply.

In the 50s and 60s, the US embarked on a spending spree, culminating in the hugely expensive Vietnam War (carpet-bombing poor countries isn’t cheap). The world was flooded with dollars, and countries started to wonder how much gold there really was to back it. In the 1960s, France got suspicious, and started to redeem dollars for gold. Other countries did the same, and the US lost 50% of its gold during the 60s.

1970s

By 1971, it was obvious that there were many times more dollars in the world than gold to back them. It was the classic goldsmith’s fraud, that had to be made official to stave off global collapse. So President Nixon went on TV to take the US off the gold exchange standard, and all the world’s currencies became fiat – i.e. they were worth something because the government said they were, and nothing else. The world entered into an age of fiat and floating exchange rates.

Since then, currencies haven’t been backed by anything, which has resulted in wild fluctuations, massive devaluations and currency speculation that’s parasitic, provides nothing useful, and thrives on instability. The more the value of currencies rise and fall, the more opportunity there is for profit from speculation. Also in the seventies, the US began the now-famous protection racket with oil-producing countries, and the petrodollar was born. Oil-producing countries were ‘persuaded’ to sell their oil only in dollars. This massively increased demand for dollars, as they were required to buy oil, which everyone needs. The US were able to print dollars freely and purchase the resources of the world, creeping ever-further into debt, whilst building the largest military force the world has ever seen – by a long, long way.

Structural adjustment: newly-independent ex-colonies were offered loans from Western banks, after years of rule by Western powers, and extraction of their resources. The interest on these loans ensured that they’d never be free of debt. When they’re unable to repay, the IMF imposes ‘structural adjustment policies’ that put control of their resources ultimately into the hands of Western banks.

1980s and 90s

There had been a ‘deal’ between capitalists and workers in the West since WW2. The deal from Western governments was: don’t become communists and we’ll give you healthcare, social security and education, plus council houses, and we’ll tie wages to productivity. But the deal changed in the 80s to: we’re going to wind back those benefits, but you can have as much credit as you like.

Banking regulations were removed, and credit went through the roof. Banks hugely extended their influence over the economy, and would be bailed out by the public if they failed. In the UK, Gordon Brown removed any last vestige of government control over the money supply when he made the Bank of England entirely independent in such matters.

Banks took advantage of gaps in the law to buy up mutually-owned savings institutions (Savings & Loan companies in the US, building societies in the UK). Only building societies with ‘asset lock’ clauses remain.

Now banks don’t have to hold any percentage of the money they create on reserve at the central bank. There were liquidity reserve ratios, which is similar, but which allows bank to buy government bonds, and the government will just put the money received into another bank – and on it goes. There were no real limit on the amount of money banks could create. Liquidity ratios were themselves abolished in 1981. There are ‘capital adequacy reserves’ – the Basel Accords – to make sure banks have a buffer if lots of loans start to go bad. But this doesn’t limit them if the economy is doing well. The ONLY limit on the amount banks can create is their confidence that borrowers can repay. The Glass-Steagall act was repealed (which means that the investment and retail arms of banking are no longer kept separate).

What could possibly go wrong?

140 years in 10 minutes. His solution is to go back to gold, which is maybe not the best idea.

2007-8

This is an overview of the build-up to the global economic crash of 2007-8:

1970s

- Lewis Ranieri of Salomon Brothers invents mortgage-backed securities (MBS).

- Mortgages are sold to investment banks, who package thousands of them together as securities (types of bonds).

- They sell the securities to third-party investors, who receive the cash flow from them.

- Because they’re large packages, they give much higher yields than individual mortgages, but with less risk, because most people pay their mortgage.

- So they catch the eye of large investors.

1980s

- Lots of legal wrangling, but MBSs become legal, as long as they’re given a good enough rating by a ratings agency.

- MBSs get triple-A ratings, make billions, and change the image of banking from Captain Mainwaring to cocaine and strip clubs.

- Banking becomes the dominant industry in the US and the UK. Bankers successfully pressure governments to deregulate their sector.

- Lots of different types of securities appear.

1990s

- Credit default swaps (CDS) are developed – insurance policies against default on debts. You can take out a CDS on anything – they’re, in effect, bets against debts being paid.

2002

- Dotcom bubble bursts. Economy wobbles, but housing seen as stable and secure. It isn’t.

- Banks push for more and more mortgages for MBSs – even from people who are big credit risks.

- If housing securities are recognised as risky, and don’t sell, they’re taken apart and repackaged as collateralised debt obligations (CDO).

- CDOs are types of derivates (their value is derived from something else – in this case the collateral if the loan defaults).

- Ratings agencies give them triple-A ratings, or they lose business to other ratings agencies who will.

- ‘Synthetic CDOs’ arrive, which are bets on other CDOs; then there are bets on those bets, and so on.

2003-4

- Hedge fund manager Michael Burry (featured in the book and movie ‘the Big Short’) and others, notice that a lot of MBSs are full of sub-prime mortgages.

- Burry begins buying CDSs on housing securities.

- He’s right, and makes a lot of money as the MBSs start to fail.

- Burry ‘short-sold’ housing securities – i.e. he bet against them.

2007-8

- MBSs have morphed into a huge number of dodgy securities.

- A large number of them fail, and crash the economy.

- Ben Bernanke and Hank Paulson bail out the banks.

- No bankers get jail time (apart from in Iceland).

- Bankers lobby governments to kill any meaningful reform.

The current situation

Currencies are no longer pegged to anything – so there are crises involving wild fluctuations and massive devaluations. Plus there’s currency speculation. The foreign exchange market is huge, and almost all based on speculation. Currency speculation is not only parasitic, providing nothing useful, but it’s an activity that thrives on instability. The more the value of currencies rise and fall, the more opportunity there is for profit from speculation.

Should we go back to the Gold (or Silver) standard? Of course not – why base the global exchange system on a commodity that has to be dug out of the ground, often in terrible conditions, often by children, causing lots of environmental damage, to be stored in the vaults of banks and concentrated in the hands of the already wealthy? It makes no sense when we have credit clearing and mutual credit?

Where does money come from now?

It’s incredible that there isn’t general agreement about how money is created (although I think we’re getting closer to it now). Money is a human creation. How can we create something and then not agree on how it’s created? There’s agreement about how stars are formed, and that’s much more complicated – or maybe it isn’t. Maybe the mechanics of money creation are more difficult to understand than the mechanics of star creation; or perhaps the waters have been deliberately muddied.

There are 3 theories of banking and the creation of money: the financial intermediation, fractional reserve and credit creation theories.

Financial intermediation

Textbooks often quote the FI theory, where banks take deposits from savers, and lend them out to borrowers. Presumably, money is assumed to come into existence only when governments print notes or mint coins. Banks make their profits from the interest they charge to borrowers, which is more than the interest they pay to savers. When this was generally discovered to be incorrect (although probably the majority of people still believe this is what happens), some textbooks started to quote the fractional reserve theory.

Fractional reserve

According to this theory, banks lend out more money than they have on deposit from savers (in the same way that goldsmiths lent out more notes than gold in their vaults to back them), as long as they keep 10% of the money they receive in reserve at the Bank of England. Then the ‘money multiplier’ effect kicks in to boost the amount of money in circulation. It works like this. Say a bank receives £100 in cash from a depositor. They keep £10 in reserve and can lend out £90. The borrower then (probably) buys something with this loan, and the seller deposits this money with their bank. Their bank sees this as ‘new’ money, keeps £9 in reserve and lends out £81 – and so on. In the end, almost £1000 is pumped into the economy from an original £100 deposit. The banks profit hugely by charging interest on money they didn’t have. In this model, the central bank can tweak the amount of money in the economy by changing the reserve ratio. In the example above, the ratio was 10% – the banks had to keep 10% of deposits in reserve. The central bank could increase the money supply by dropping this to 5%, say, or reduce it by increasing the reserve ratio to 20%. However, this model isn’t correct either, although you can find lots of economics textbooks that say it is.

Credit creation

There’s no fractional reserve banking in the UK. Now banks can lend as much as they like, with no reserve requirements whatsoever, knowing that they’ll be bailed out if it all goes horribly wrong. The amount they lend is only dependent on the banks’ confidence that borrowers will pay it back. Banks have a government monopoly on the creation of money as credit, or if you like, as debt. So when someone borrows money from a bank – for a mortgage or a business loan – that’s when most money is created, out of thin air. This seemed unlikely to many, until it was proven by Richard Werner, and the Bank of England confirmed it in a bulletin in 2014.

It’s all accounted for with double-entry book-keeping. Banks register a £1000 loan as an asset – because someone then owes them £1000. But when they make the loan, they deposit £1000 into the customer’s account, and money in an account is a liability – a promise to pay. So the asset and the liability are for the same amount, and therefore cancel each other out, and nothing seems to have happened, even though there’s an additional £1000 sloshing around in the economy. This accounts for around 97% of all money in existence. Less than 3% is provided by the central bank when they print notes and mint coins.

We’ve been here before, by the way. Early banks used to issue their own banknotes (as promises to pay gold when demanded). They then charged interest on this magic money, until, in the 19th century, the Conservative government of Robert Peel attempted to stop banks lending and charging interest on money they didn’t have, by bringing in the Bank Charter Act of 1844, after which only the Bank of England could issue bank notes. However, the act didn’t prevent banks from lending money by creating deposits in customers’ bank accounts. Customers could pay for things using cheques, and no banknotes were required at all.

Positive Money conducted a poll of MPs, and found that 85% of them didn’t know where money comes from, which is a bit of a worry. J K Galbraith said that “The process by which banks create money is so simple that the mind is repelled”. Maybe that’s what it is – people hear it but can’t really believe it. But I think that’s changing now.

The symbiotic relationship between state and banks

Governments don’t have control over the total amount of money in the economy. That’s down to the activities of banks, although states and banks now have a symbiotic relationship. Banking is perhaps the least trusted of professions (with the possible exception of politics). Banks don’t share their profits with taxpayers, but their losses are forced onto us. They make big decisions that affect everyone in the world, without consulting us, and they’re beyond effective regulation. It’s not a question of ‘evil bankers’ – most of them don’t understand how the money system works or where money comes from either. It’s about a system that’s evolved, and has been gradually manipulated to concentrate wealth in ever-fewer hands, and that slowly destroys our ability to do anything about it.

The basic relationship is this: the state gives a monopoly licence to the banks to create money from nothing, as debt, with compound interest attached. Security is provided by the borrower, usually in the form of bricks and mortar, which is sometimes appropriated by the banks – especially when the economy crashes. The banks reciprocate by funding the state machine when they purchase government bonds (promises to pay in the future – a bond is an IOU, in other words). Banks have no restrictions on the amount of money they can create (and charge interest on), with nothing to back it. This is as true for the purchase of government bonds as it is for loans to businesses and individuals.

The future

The battle between the money men and everyone else continues. In the quest for power, the money men have defeated Roman emperors, the church, kings, US presidents and now, Islam (think Dubai). In other words, they have an awful lot of power. Financial institutions find ways around restrictions with more and more complex financial transactions, and the boom in the use of credit cards. The movement of money across national borders makes it even more difficult for a government or central bank to control money, and almost impossible for most people to even understand it.

There have been plenty of proposed solutions to curb this power – taking control of the money supply into the hands of the state in various ways (but the relationship between banks and state is so strong, this seems unlikely; and it would only put the same damaging game under slightly different management); Facebook have ideas for a global payments system called Diem – but transferring power from banks to Facebook doesn’t sound like much of a solution; crypto has been interesting, but is mainly about speculation rather than trade; mutual credit is certainly looking interesting too – no more money scarcity, and control of the exchange medium in the hands of the public.

Economists tend to see themselves as concerned with the ‘real’ economy, and they see money as a mere means of exchange that concerns accountants, not them. And yet now money is a commodity in itself, and by far the most traded commodity in the world. So money is anything but a neutral medium of exchange (a surrogate for barter) – its main role in the current economy is to make more money. Private banks bring money into circulation, as debt, with compound interest attached to it, and they decide how much to lend and to whom, based on profitability, rather than what’s good for society.

We can do much better than this.