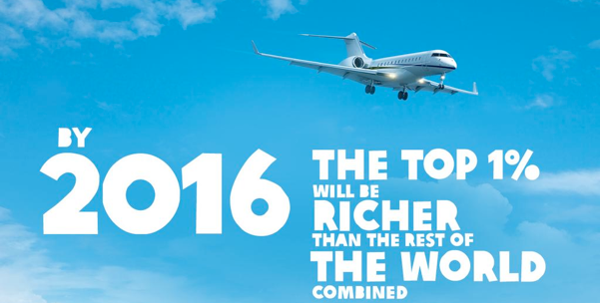

Have we all suffered equally since the crash of 2008? Have we all shared in the austerity? Well, no – the gap between the rich and the poor is widening in the UK, the US and in fact, in the OECD. In the US, Robert Reich reports that 95% of economic gains since 2009 have gone to the top 1%.

How has this happened? Why are the poor paying for the crash, and why is wealth and power concentrating in fewer and fewer hands?

Well, the first thing to happen after the crash was the bailing out of the giant, ‘too big to fail’ corporate banks using the tax money of ordinary people – all of us. This was a massive transfer of wealth upwards towards the already wealthy. Meanwhile, the crash meant the liquidation of millions of small businesses who of course were ‘too small to matter’.

Another important factor is that Western central banks – the Federal Reserve and Bank of England, for example, are private institutions with commercial banks as their shareholders – therefore ultimately, the super-rich majority shareholders of the world’s biggest private banks are in control of Western governments’ monetary policy – from interest rates to money creation.

Policies are suggested – renationalise central banks for example. But who is going to do it? Anything that any particular national government introduces that reduces shareholder profits will result in capital flight from that country – and everyone knows it, which is why it happens so rarely. And when it does, as with Syriza in Greece, capital flight pulls them back into line and forces them to reverse their policies.

So it seems clear that policy suggestions are impotent, even if they were to happen. Systemic change is the only thing to challenge the dominance of capital in the world. Let’s not waste our breath talking about policy changes. Instead, let’s use our collective intelligence to design and implement an alternative economic and political system – one that capital has no access to. Otherwise, we should stop talking about ‘liberal democracies’ and call our systems what they really are – corporate dictatorships.

Also, within the current power structure, renationalising banks would bring them under state control but not public control. There are other options, whereby financial institutions are directly owned by the public. For example, mutual societies (building societies) in the UK, that are owned by their members. At one time there were hundreds of them all over the country, named after their town of origin. They were targeted by corporate governments from the 1980s, when they were allowed to demutualise (i.e. become corporate banks with shareholders) if a vote of members resulted in 75% agreeing to do so. Financial incentives were offered to members to vote for demutualisation, and now there are only around 45 building societies left. The Nationwide is one of them, and will stay that way for the foreseeable future, due to members having to sign a legal document waiving the right to any financial reward if the society is ever demutualised. A stroke of genius, and an idea that needs to be used in the formation of any new types of mutually-owned organisation.

In the US, the corresponding institution was a savings and loan association. Again, they were largely taken out when the Federal Reserve doubled interest rates in 1979, leaving them with mostly long-term, fixed-rate mortgages that they couldn’t increase income from to match the doubled interest that they then had to pay on their deposits.

The UK also had the Trustee Savings Bank – a slightly watered-down building society, in that their shares weren’t traded, but members didn’t have voting rights. Australia had a nationalised bank – the Commonwealth Bank of Australia – that was fully privatised in the 1990s after deregulation of the financial industry by the corporate-state coalition.

However, we still have some non-corporate and non-state options for savings, loans, mortgages etc, many with all the functions of a corporate bank. See credit unions, cryptocurrencies, and of course we still have building societies.

The conclusions are:

- The crash of 2008 resulted in a multi-trillion-dollar transfer of wealth from those with the least money to those with the most.

- This is due to influence over financial policy by those with the most money.

- Policy changes won’t affect this because of the power of capital flight.

- We need new economic and political systems that capital can’t infiltrate or influence.

- In the meantime, mutual societies, credit unions and cryptocurrencies provide alternatives to the corporate banking system.

1 Comment

ah … if only our governments would serve us.