Steady-state economics - introduction

“Anyone who believes exponential growth can go on forever in a finite world is either a madman or an economist.” – Kenneth Boulding

“GDP measures everything in short, except that which makes life worthwhile.” – Robert F. Kennedy

Contents

What is steady-state economics?

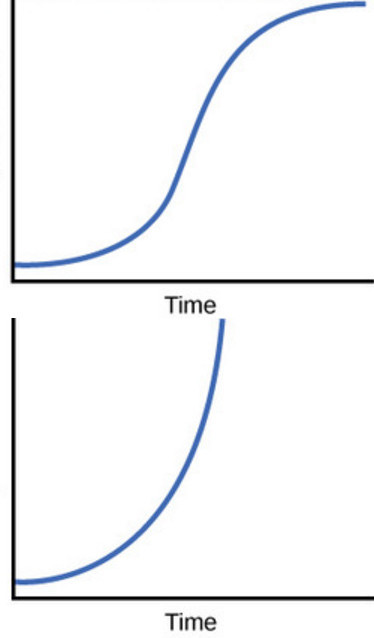

A steady-state economy is one that doesn’t have to perpetually grow. It’s not about recession, which is neither planned nor desired. It’s about stabilising the economy in a controlled way.

Early economists assumed that economies had to stabilise at some point, but over time, their assumptions were sidelined in favour of a quest for ever-increasing profits.

Meadows et al. in Limits to Growth call the combination of human resource use and waste ‘throughput’ – and that growth increases throughput, which destroys nature, and if we don’t stop destroying the biosphere of our home planet, we’ll destroy ourselves.

Economics as a subset of the natural environment

Herman Daly puts it very well. He says that conventional economists view the economy as an isolated system, and don’t recognise that it’s a subset of the environment, completely dependent on inputs from it (low-entropy, useful raw materials), and outputs to it (high-entropy, useless waste). The earth (plus its biosphere) is a finite, non-growing system. Therefore any subset of it must be finite and eventually non-growing. This stabilisation can come about sensibly, deliberately and safely, or it can be resisted until nature imposes it, which will be nasty.

Various powerful civilizations have come to a sticky end due to overexploitation of their surrounding environment. We’re doing the same thing globally now, and we have nowhere else to go. The world now spends over $1 trillion annually on advertising to persuade, cajole, pester and shame people into buying more stuff, which forces the economy to grow. No amount of green technology, organic food or recycling will stop environmental destruction as long as our economy is constantly growing.

So why is humanity chasing perpetual global GDP growth if it’s so damaging?

Because we live in a global corporate empire that needs growth to maintain its profits and power, and in fact, if any corporation abandons the quest for growth unilaterally, it would go out of business as other corporations snatch its market share. And the situation is even worse for countries, who know that they’re in competition for resources with other countries – competition that ultimately ends in war. So every country (or alliance of countries) needs to maximise its military power, and the way to do that is via perpetual growth.

Also, all countries are now capitalist, and capitalism has a ‘growth imperative’ – i.e. it requires growth forever, or it falls into recession, then depression. This is the real reason we’re told that the global economy can grow forever – because it would require a new system, which the corporate empire of course doesn’t want, and as it owns the mainstream media and controls the political system, growth is always promoted.

Different indices have been suggested for well-being, rather than GDP (such as Gross National Happiness or the Genuine Progress Index), and some economists are proposing alternatives. The problem with most of them is that they ask governments to stabilise the economy – which isn’t going to happen because of corporate capture. For example, Herman Daly’s Steady-State Economics involves working out how much ecological impact is sustainable, then ensuring that we stay below that level with (tradeable) resource depletion quotas (for each resource) and a ‘maximum wealth’ policy. Income from depletion quotas would then be used to build the infrastructure to move to a renewable, low-carbon society. It also involves moving taxation to throughput and away from income.

How are we persuaded that perpetual growth is possible?

We’re told that a combination of technology and innovation will increase resource efficiency – i.e. will reduce throughput for the same amount of output. And governments tell us that economic growth can be ‘decoupled’ from throughput and destruction of nature – a claim that has been thoroughly debunked. This decoupling has never happened, and never will. Global throughput (and therefore biosphere damage) has been growing steadily each year for the last 200 years, because although technology improves efficiency, the reduction in throughput that could have been achieved in a stable economy is completely reversed because of economic growth.

Jevons Paradox

Another intriguing reason that it can’t happen is down to the Jevons paradox. Basically, any technological improvement that increases efficiency in the use of a particular resource, actually increases the use of that resource, because it becomes more financially and technologically viable to use it. The classic example is James Watt’s steam engine. At the time of its invention, it was thought that it would reduce coal use, because it did the same work as the Newcomen engine with much less coal. But of course, there was a massive increase in the use of coal because of the massive increase in the number of engines and in human activity generally. There have been similar studies for other technologies and resources, but the results are the same. Khazzoom & Brookes, for example, showed that energy efficiency measures increase energy use at the macro level. The idea that efficiency reduces resource use only works in a stable economy, not a growing one.

Terminology

Apart from steady-state economics, you might come across degrowth, post-growth, ecological economics and doughnut economics, which have similar positions. All of them rely on states to do something to stabilise the economy, whether it’s via taxation, legislation, removal of corporate subsidies, ‘Green New Deal’, circular economy, universal basic services, carbon trading, well-being indicators, wealth caps, bans on advertising, shorter workweeks, debt cancellation etc. But states are very unlikely to deviate from attempts to maximise growth. The Commons Economy, on the other hand, has no growth imperative, and it’s something we can do ourselves, in our communities.

As wealthy countries’ economies are already too big, there has to be some degrowth before stabilisation (with growth in poor countries so that both meet at a reasonable per capita level). Global GDP per capita is around $20k, which the World Bank ranks as ‘high income’, so if poor countries grew to that, and rich countries shrank to it, everyone in the world could live with what is now considered a high income. That’s not possible in a capitalist economy though, as capitalism has a ‘wealth-concentration imperative’ (the richest 5% capture nearly half of global GDP), pushing most people well below that $20k.

And this degrowth doesn’t have to be the same for each sector. For example, public transport and renewables can grow, while fossil fuels, weapons, pesticides and advertising shrink.

Doughnut economics: great idea, but could do with getting of the fence when it comes to perpetual growth, rather than being ‘agnostic‘.

One more term: ‘green growth‘ – which really isn’t a thing.

What are the benefits of steady-state economics?

Nature

It’s impossible for us to live in harmony with nature and to have a constantly growing economy. One of these aspirations has to go – we suggest it’s the latter. If you don’t find that self-evident, here’s a simple, four-point explanation:

Growth in global material resource use and waste can’t continue forever – i.e. there’s not a single thing that we can have more of every year – not cars, houses, socks or safety pins.

Global economic growth results in an increase in overall spending power (that extra output needs to be sold). If it doesn’t increase overall spending power, it’s not economic growth, it’s growth in something else, or maybe a devaluation of the currency – but it’s not economic growth. The Bank of England agrees: ‘when GDP goes up, people are spending more‘.

It’s not possible to ring-fence that increase in spending power so that it’s never spent on material things. If people have more money, they buy more cars, TVs, clothes, flights, second homes etc. This is obvious, surely; Footballer Andrey Shevchenko famously had nine Ferraris. I’m sure he would have had ninety if he’d had more money.

Therefore it’s not possible to de-link economic growth from material growth, which makes perpetual economic growth impossible.

Democracy & Community

Perpetual growth is required to maintain corporate capitalism, and so regardless of the damage done to nature, community or people, that’s what the corporate sector is going to promote. Corporations are not human, and so appeals to community, democracy and humanity don’t work. They’re programmed to seek profits, whatever the consequences, and that’s exactly what they’re doing (with terrible consequences, unsurprisingly).

People

GDP doesn’t measure human well-being. It includes things like cleaning up pollution, weapons manufacture, prisons, insurance claims, cigarettes and car accidents, but doesn’t include things that are free, like love, enjoying nature, napping, looking after kids, singing, meditation, sunbathing or just chatting with friends – so how can it measure well-being? As capitalism encroaches on poor countries, people are pushed off their land – where they can build their own homes, grow their own food, and live in communities where people look after each other – and into slums and sweatshops where they can earn a few dollars a day. GDP rises, but people’s welfare and ability to look after themselves falls. Then, after people’s ability to self-provision has been removed, and they’ve been forced into the capitalist economy to enrich the corporate sector, GDP growth brings benefits as infant mortality rates fall, life expectancy increases, welfare states appear, along with health care, education and reliable infrastructure. But as an economy grows further, benefits stop increasing, then start to fall, and we get more stress, congestion, crime, pollution, noise, ugliness, ill-health, boring work and lack of community. But it’s the damage to nature that’s the greatest threat to humans.

Peace

A global scamble for resources between countries armed to the teeth, on a planet of finite resources can only lead to one thing: more-or-less perpetual war – which is indeed what we’ve got.

What can I do?

Individually, downshifting allows you to stop feeding growth. Then, to help ‘big picture’ change, support a commons economy, which unlike capitalism, has no growth imperative (because it allows people to get what they need with less money, and doesn’t siphon wealth out of communities to the corporates). We could suggest policies, but voting won’t do it, as all electable parties want forever growth, and the state is a corporate partner. Having said that, if any party can introduce policies or legislation to slow growth, or even to stop treating it as sacred, that would be an excellent (if very surprising) thing.

Also – be ready to counter these myths.

Further resources

- Degrowth Database – massive – academic papers, books, news, policies etc.

Jason Hickel – probably the best degrowth blog

Center for the Advancement of the Steady State Economy (CASSE)

Herman Daly’s 1977 classic, Steady-State Economics

- Timothee Parrique, The Political Economy of Degrowth

Specialist(s)

The specialist(s) below will respond to queries on this topic. Please comment in the box at the bottom of the page.

Brian Czech is the president of CASSE (Centre for the Advancement of the Steady State Economy). He served in the U.S. Fish and Wildlife Service from 1999-2017, and as a visiting professor of natural resource economics in Virginia Tech’s National Capitol Region. He is the author of Supply Shock, Shoveling Fuel for a Runaway Train, and The Endangered Species Act: History, Conservation Biology, and Public Policy, as well as over 50 academic journal articles.

4 Comments

I concur with everything on your website. Love it! How are you on use of sovereign money i.e. money put into an economy as needed to create ‘stable state economics’ – rather than private bank controlled fractional reserve loans which are really debts created of balance sheets, which banks take a fee or interest on, which isn’t real money, as the amount once repaid has to be created as new debt loans, in order to maintain the availability of money needed in a system. Positive Money are trying to bring change to the ways money can be provided, which will better aid ordinary people’s lives.

I have a blog you may be interested in: http://www.lifecentrestage.wordpress.com

I’m sure we have many things in common. I can certainly learn from you and will take it on board in my own projects as they progress. Best wishes for now. Richard Sibley.

Yes, I’ve covered that several times on the blog – most recently here https://www.lowimpact.org/why-the-banks-have-so-much-power-and-how-we-can-take-it-away-from-them/ – but it’s not fractional reserve banking that we have in the UK any more, it’s zero reserve banking. See https://en.wikipedia.org/wiki/Reserve_requirement#United_Kingdom. The Basel Accords require some sort of liquidity requirements however – I’m looking into what that actually means for banks, and if and how they can get round them, or if they even need to.

I’m taking a MOOC at the moment, which covers the history of money and banking, the problems it causes, and possible solutions. It happens every 6 months – next one starting in February. You might be interested. It’s here – http://iflas.blogspot.co.uk/2014/12/money-and-society-mooc.html

You might also be interested to hear that Steve Keen believes that debt can be repaid by increasing the velocity of money rather than by creating further debt. Or at least he believes it’s mathematically possible, as long as lenders spend debt repayments back into the economy to create more work. See https://www.forbes.com/sites/stevekeen/2015/03/30/the-principal-and-interest-on-debt-myth-2. Leaving aside the fact that this (in my mind) amounts to a form of slavery, it still doesn’t mean that it’s sustainable. I’ve been having debates with economists on the MOOC, and I slowly realised that ‘sustainability’ to an economist means ‘there’s enough money to pay transactions, debt and interest’, whereas to me it means ‘our economy doesn’t destroy nature’. Economists don’t understand ecology – the fact that the human economy is a subset of global ecology. I had a conversation with an economics student this year, who said that ecology was a subset of economics. It perfectly illustrates the idiocy of mainstream economics.

I stumbled across this video of a speech by Sir David Attenborough from 2017. His main thrust is the problem of population growth but also the insanity of talking about infinite growth in a finite system. He even uses the Kenneth Boulding quotation from the start of this post. It’s about 15 minutes but well worth your time. The comments on the madness of ‘sustainable growth’ could have come straight from this site.

John – yes, it’s the ‘material growth’ part that pro-growthers try to avoid. They claim that economic growth can be ‘immaterial’, when it’s easy to show that it can’t – other kinds of growth (artistic, intellectual, emotional, spiritual), yes, but economic growth, no [to summarise, economic growth = higher GDP = more spending power = more material things purchased = absolutely irrefutable, although (most but not all) economists do try to refute it, hence Boulding’s quote].

Plus I think the Green Revolution caused more problems than it solved.

I know he’s talking about population, but the concept of sustainable growth is just as wrong when it comes to economics.